Introduction

Overview

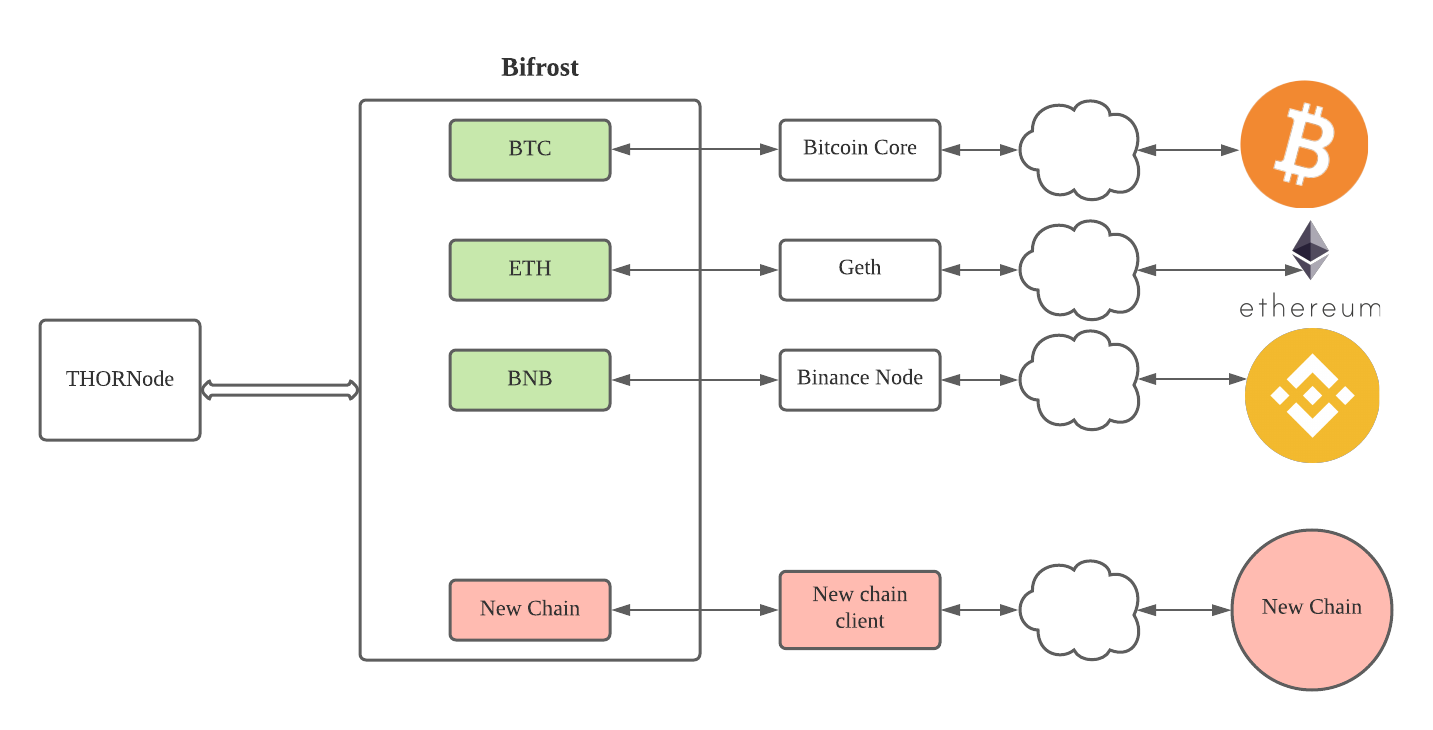

THORChain is a decentralised cross-chain liquidity protocol that allows users to add liquidity or swap over that liquidity. It does not peg or wrap assets. Swaps are processed as easily as making a single on-chain transaction.

THORChain works by observing transactions to its vaults across all the chains it supports. When the majority of nodes observe funds flowing into the system, they agree on the user's intent (usually expressed through a memo within a transaction) and take the appropriate action.

For more information see Understanding THORChain Technology or Concepts.

For wallets/interfaces to interact with THORChain, they need to:

- Connect to THORChain to obtain information from one or more endpoints.

- Construct transactions with the correct memos.

- Send the transactions to THORChain Inbound Vaults.

Front-end guides have been developed for fast and simple implementation.

Front-end Development Guides

Native Swaps Guide

Frontend developers can use THORChain to access decentralised layer1 swaps between BTC, ETH, BNB, ATOM and more.

Native Savings Guide

THORChain offers a Savings product, which earns yield from Swap fees. Deposit Layer1 Assets to earn in-kind yield. No lockups, penalties, impermanent loss, minimums, maximums or KYC.

Aggregators

Aggregators can deploy contracts that use custom swapIn and swapOut cross-chain aggregation to perform swaps before and after THORChain.

Eg, swap from an asset on Sushiswap, then THORChain, then an asset on TraderJoe in one transaction.

Concepts

In-depth guides to understand THORChain's implementation have been created.

Libraries

Several libraries exist to allow for rapid integration. xchainjs has seen the most development is recommended.

Eg, swap from layer 1 ETH to BTC and back.

Analytics

Analysts can build on Midgard or Flipside to access cross-chain metrics and analytics. See Connecting to THORChain for more information.

Connecting to THORChain

THORChain has several APIs with Swagger documentation.

- Midgard - https://midgard.ninerealms.com/v2/doc

- THORNode - https://thornode.ninerealms.com/thorchain/doc

- Cosmos RPC - https://v1.cosmos.network/rpc/v0.45.1, Example Link

See Connecting to THORChain for more information.

Support and Questions

Join the THORChain Dev Discord for any questions or assistance.

Quickstart Guide

Introduction

THORChain allows native L1 Swaps. On-chain Memos are used instruct THORChain how to swap, with the option to add price limits and affiliate fees. THORChain nodes observe the inbound transactions and when the majority have observed the transactions, the transaction is processed by threshold-signature transactions from THORChain vaults.

Let's demonstrate decentralized, non-custodial cross-chain swaps. In this example, we will build a transaction that instructs THORChain to swap native Bitcoin to native Ethereum in one transaction.

The following examples use a free, hosted API provided by Nine Realms. If you want to run your own full node, please see connecting-to-thorchain.md.

1. Determine the correct asset name

THORChain uses a specific asset notation. Available assets are at: Pools Endpoint.

BTC => BTC.BTC

ETH => ETH.ETH

2. Query for a swap quote

All amounts are 1e8. Multiply native asset amounts by 100000000 when dealing with amounts in THORChain. 1 BTC = 100,000,000.

Request: Swap 1 BTC to ETH and send the ETH to 0x3021c479f7f8c9f1d5c7d8523ba5e22c0bcb5430.

Response:

{

"dust_threshold": "10000",

"expected_amount_out": "1619355520",

"expiry": 1689143119,

"fees": {

"affiliate": "0",

"asset": "ETH.ETH",

"outbound": "240000"

},

"inbound_address": "bc1qpzs9rm82m08u48842ka59hyxu36wsgzqlt6e3t",

"inbound_confirmation_blocks": 1,

"inbound_confirmation_seconds": 600,

"max_streaming_quantity": 0,

"memo": "=:ETH.ETH:0x86d526d6624AbC0178cF7296cD538Ecc080A95F1",

"notes": "First output should be to inbound_address, second output should be change back to self, third output should be OP_RETURN, limited to 80 bytes. Do not send below the dust threshold. Do not use exotic spend scripts, locks or address formats (P2WSH with Bech32 address format preferred).",

"outbound_delay_blocks": 305,

"outbound_delay_seconds": 1830,

"recommended_min_amount_in": "60000",

"slippage_bps": 49,

"streaming_swap_blocks": 0,

"total_swap_seconds": 2430,

"warning": "Do not cache this response. Do not send funds after the expiry."

}

If you send 1 BTC to bc1qlccxv985m20qvd8g5yp6g9lc0wlc70v6zlalz8 with the memo =:ETH.ETH:0x3021c479f7f8c9f1d5c7d8523ba5e22c0bcb5430, you can expect to receive 13.4493552 ETH.

For security reasons, your inbound transaction will be delayed by 600 seconds (1 BTC Block) and 2040 seconds (or 136 native THORChain blocks) for the outbound transaction, 2640 seconds all up*. You will pay an outbound gas fee of 0.0048 ETH and will incur 41 basis points (0.41%) of slippage.*

Full quote swap endpoint specification can be found here: https://thornode.ninerealms.com/thorchain/doc/.

See an example implementation here.

If you'd prefer to calculate the swap yourself, see the Fees section to understand what fees need to be accounted for in the output amount. Also, review the Transaction Memos section to understand how to create the swap memos.

3. Sign and send transactions on the from_asset chain

Construct, sign and broadcast a transaction on the BTC network with the following parameters:

Amount => 1.0

Recipient => bc1qlccxv985m20qvd8g5yp6g9lc0wlc70v6zlalz8

Memo => =:ETH.ETH:0x3021c479f7f8c9f1d5c7d8523ba5e22c0bcb5430

Never cache inbound addresses! Quotes should only be considered valid for 10 minutes. Sending funds to an old inbound address will result in loss of funds.

Learn more about how to construct inbound transactions for each chain type here: Sending Transactions

4. Receive tokens

Once a majority of nodes have observed your inbound BTC transaction, they will sign the Ethereum funds out of the network and send them to the address specified in your transaction. You have just completed a non-custodial, cross-chain swap by simply sending a native L1 transaction.

Additional Considerations

There is a rate limit of 1 request per second per IP address on /quote endpoints. It is advised to put a timeout on frontend components input fields, so that a request for quote only fires at most once per second. If not implemented correctly, you will receive 503 errors.

For best results, request a new quote right before the user submits a transaction. This will tell you whether the expected_amount_out has changed or if the inbound_address has changed. Ensuring that the expected_amount_out is still valid will lead to better user experience and less frequent failed transactions.

Price Limits

Specify tolerance_bps to give users control over the maximum slip they are willing to experience before canceling the trade. If not specified, users will pay an unbounded amount of slip.

https://thornode.ninerealms.com/thorchain/quote/swap?amount=100000000&from_asset=BTC.BTC&to_asset=ETH.ETH&destination=0x3021c479f7f8c9f1d5c7d8523ba5e22c0bcb5430&tolerance_bps=100

Notice how a minimum amount (1342846539 / ~13.42 ETH) has been appended to the end of the memo. This tells THORChain to revert the transaction if the transacted amount is more than 100 basis points less than what the expected_amount_out returns.

Affiliate Fees

Specify affiliate and affiliate_bps to skim a percentage of the swap as an affiliate fee. When a valid affiliate address and affiliate basis points are present in the memo, the protocol will skim affiliate_bps from the inbound swap amount and swap this to $RUNE with the affiliate address as the destination address.

Params:

- affiliate: Can be a THORName or valid THORChain address

- affiliate_bps: 0-1000 basis points

Memo format:

=:BTC.BTC:<destination_addr>:<limit>:<affiliate>:<affiliate_bps>

Quote example:

{

"dust_threshold": "10000",

"expected_amount_out": "1603383828",

"expiry": 1688973775,

"fees": {

"affiliate": "1605229",

"asset": "ETH.ETH",

"outbound": "240000"

},

"inbound_address": "bc1qhkutxeluztncm5pq0ckpm75hztrv7m7nhhh94d",

"inbound_confirmation_blocks": 1,

"inbound_confirmation_seconds": 600,

"max_streaming_quantity": 0,

"memo": "=:ETH.ETH:0x3021c479f7f8c9f1d5c7d8523ba5e22c0bcb5430::thorname:10",

"notes": "First output should be to inbound_address, second output should be change back to self, third output should be OP_RETURN, limited to 80 bytes. Do not send below the dust threshold. Do not use exotic spend scripts, locks or address formats (P2WSH with Bech32 address format preferred).",

"outbound_delay_blocks": 303,

"outbound_delay_seconds": 1818,

"recommended_min_amount_in": "72000",

"slippage_bps": 49,

"streaming_swap_blocks": 0,

"total_swap_seconds": 2418,

"warning": "Do not cache this response. Do not send funds after the expiry."

}

Notice how thorname:10 has been appended to the end of the memo. This instructs THORChain to skim 10 basis points from the swap. The user should still expect to receive the expected_amount_out, meaning the affiliate fee has already been subtracted from this number.

For more information on affiliate fees: fees.md.

Streaming Swaps

Streaming Swaps can be used to break up the trade to reduce slip fees.

Params:

- streaming_interval: # of THORChain blocks between each subswap. Larger # of blocks gives arb bots more time to rebalance pools. For deeper/more active pools a value of

1is most likely okay. For shallower/less active pools a larger value should be considered. - streaming_quantity: # of subswaps to execute. If this value is omitted or set to

0the protocol will calculate the # of subswaps such that each subswap has a slippage of 5 bps.

Memo format:

=:BTC.BTC:<destination_addr>:<limit>/<streaming_interval>/<streaming_quantity>

Quote example:

{

"approx_streaming_savings": 0.99930555,

"dust_threshold": "10000",

"expected_amount_out": "145448080",

"expiry": 1689117597,

"fees": {

"affiliate": "0",

"asset": "ETH.ETH",

"outbound": "480000"

},

"inbound_address": "bc1qk2z8luw2afwuugndynegn72dkv45av5hyjrtm8",

"inbound_confirmation_blocks": 1,

"inbound_confirmation_seconds": 600,

"max_streaming_quantity": 1440,

"memo": "=:ETH.ETH:0x3021c479f7f8c9f1d5c7d8523ba5e22c0bcb5430:0/10/1440",

"notes": "First output should be to inbound_address, second output should be change back to self, third output should be OP_RETURN, limited to 80 bytes. Do not send below the dust threshold. Do not use exotic spend scripts, locks or address formats (P2WSH with Bech32 address format preferred).",

"outbound_delay_blocks": 76,

"outbound_delay_seconds": 456,

"recommended_min_amount_in": "158404",

"slippage_bps": 8176,

"streaming_swap_blocks": 14400,

"streaming_swap_seconds": 86400,

"total_swap_seconds": 87456,

"warning": "Do not cache this response. Do not send funds after the expiry."

}

Notice how approx_streaming_savings shows the savings by using streaming swaps. total_swap_seconds also shows the amount of time the swap will take.

Custom Refund Address

By default, in the case of a refund the protocol will return the inbound swap to the original sender. However, in the case of protocol <> protocol interactions, many times the original sender is a smart contract, and not the user's EOA. In these cases, a custom refund address can be defined in the memo, which will ensure the user will receive the refund and not the smart contract.

Params:

- refund_address: User's refund address. Needs to be a valid address for the inbound asset, otherwise refunds will be returned to the sender

Memo format:

=:BTC.BTC:<destination>/<refund_address>

{

...

"memo": "=:BTC.BTC:bc1qyl7wjm2ldfezgnjk2c78adqlk7dvtm8sd7gn0q/0x3021c479f7f8c9f1d5c7d8523ba5e22c0bcb5430",

...

}

Error Handling

The quote swap endpoint simulates all of the logic of an actual swap transaction. It ships with comprehensive error handling.

.png) This error means the swap cannot be completed given your price tolerance.

.png)

This error ensures the destination address is for the chain specified by to_asset.

.png) This error is due to the fact the affiliate address is too long given the source chain's memo length requirements. Try registering a THORName to shorten the memo.

.png) This error means the requested asset does not exist.

.png)

Bound checks are made on both affiliate_bps and tolerance_bps.

Support

Developers experiencing issues with these APIs can go to the Developer Discord for assistance. Interface developers should subscribe to the #interface-alerts channel for information pertinent to the endpoints and functionality discussed here.

Quickstart Guide

Introduction

THORChain allows native L1 Swaps. On-chain Memos are used instruct THORChain how to swap, with the option to add price limits and affiliate fees. THORChain nodes observe the inbound transactions and when the majority have observed the transactions, the transaction is processed by threshold-signature transactions from THORChain vaults.

Let's demonstrate decentralized, non-custodial cross-chain swaps. In this example, we will build a transaction that instructs THORChain to swap native Bitcoin to native Ethereum in one transaction.

The following examples use a free, hosted API provided by Nine Realms. If you want to run your own full node, please see connecting-to-thorchain.md.

1. Determine the correct asset name

THORChain uses a specific asset notation. Available assets are at: Pools Endpoint.

BTC => BTC.BTC

ETH => ETH.ETH

2. Query for a swap quote

All amounts are 1e8. Multiply native asset amounts by 100000000 when dealing with amounts in THORChain. 1 BTC = 100,000,000.

Request: Swap 1 BTC to ETH and send the ETH to 0x3021c479f7f8c9f1d5c7d8523ba5e22c0bcb5430.

Response:

{

"dust_threshold": "10000",

"expected_amount_out": "1619355520",

"expiry": 1689143119,

"fees": {

"affiliate": "0",

"asset": "ETH.ETH",

"outbound": "240000"

},

"inbound_address": "bc1qpzs9rm82m08u48842ka59hyxu36wsgzqlt6e3t",

"inbound_confirmation_blocks": 1,

"inbound_confirmation_seconds": 600,

"max_streaming_quantity": 0,

"memo": "=:ETH.ETH:0x86d526d6624AbC0178cF7296cD538Ecc080A95F1",

"notes": "First output should be to inbound_address, second output should be change back to self, third output should be OP_RETURN, limited to 80 bytes. Do not send below the dust threshold. Do not use exotic spend scripts, locks or address formats (P2WSH with Bech32 address format preferred).",

"outbound_delay_blocks": 305,

"outbound_delay_seconds": 1830,

"recommended_min_amount_in": "60000",

"slippage_bps": 49,

"streaming_swap_blocks": 0,

"total_swap_seconds": 2430,

"warning": "Do not cache this response. Do not send funds after the expiry."

}

If you send 1 BTC to bc1qlccxv985m20qvd8g5yp6g9lc0wlc70v6zlalz8 with the memo =:ETH.ETH:0x3021c479f7f8c9f1d5c7d8523ba5e22c0bcb5430, you can expect to receive 13.4493552 ETH.

For security reasons, your inbound transaction will be delayed by 600 seconds (1 BTC Block) and 2040 seconds (or 136 native THORChain blocks) for the outbound transaction, 2640 seconds all up*. You will pay an outbound gas fee of 0.0048 ETH and will incur 41 basis points (0.41%) of slippage.*

Full quote swap endpoint specification can be found here: https://thornode.ninerealms.com/thorchain/doc/.

See an example implementation here.

If you'd prefer to calculate the swap yourself, see the Fees section to understand what fees need to be accounted for in the output amount. Also, review the Transaction Memos section to understand how to create the swap memos.

3. Sign and send transactions on the from_asset chain

Construct, sign and broadcast a transaction on the BTC network with the following parameters:

Amount => 1.0

Recipient => bc1qlccxv985m20qvd8g5yp6g9lc0wlc70v6zlalz8

Memo => =:ETH.ETH:0x3021c479f7f8c9f1d5c7d8523ba5e22c0bcb5430

Never cache inbound addresses! Quotes should only be considered valid for 10 minutes. Sending funds to an old inbound address will result in loss of funds.

Learn more about how to construct inbound transactions for each chain type here: Sending Transactions

4. Receive tokens

Once a majority of nodes have observed your inbound BTC transaction, they will sign the Ethereum funds out of the network and send them to the address specified in your transaction. You have just completed a non-custodial, cross-chain swap by simply sending a native L1 transaction.

Additional Considerations

There is a rate limit of 1 request per second per IP address on /quote endpoints. It is advised to put a timeout on frontend components input fields, so that a request for quote only fires at most once per second. If not implemented correctly, you will receive 503 errors.

For best results, request a new quote right before the user submits a transaction. This will tell you whether the expected_amount_out has changed or if the inbound_address has changed. Ensuring that the expected_amount_out is still valid will lead to better user experience and less frequent failed transactions.

Price Limits

Specify tolerance_bps to give users control over the maximum slip they are willing to experience before canceling the trade. If not specified, users will pay an unbounded amount of slip.

https://thornode.ninerealms.com/thorchain/quote/swap?amount=100000000&from_asset=BTC.BTC&to_asset=ETH.ETH&destination=0x3021c479f7f8c9f1d5c7d8523ba5e22c0bcb5430&tolerance_bps=100

Notice how a minimum amount (1342846539 / ~13.42 ETH) has been appended to the end of the memo. This tells THORChain to revert the transaction if the transacted amount is more than 100 basis points less than what the expected_amount_out returns.

Affiliate Fees

Specify affiliate and affiliate_bps to skim a percentage of the swap as an affiliate fee. When a valid affiliate address and affiliate basis points are present in the memo, the protocol will skim affiliate_bps from the inbound swap amount and swap this to $RUNE with the affiliate address as the destination address.

Params:

- affiliate: Can be a THORName or valid THORChain address

- affiliate_bps: 0-1000 basis points

Memo format:

=:BTC.BTC:<destination_addr>:<limit>:<affiliate>:<affiliate_bps>

Quote example:

{

"dust_threshold": "10000",

"expected_amount_out": "1603383828",

"expiry": 1688973775,

"fees": {

"affiliate": "1605229",

"asset": "ETH.ETH",

"outbound": "240000"

},

"inbound_address": "bc1qhkutxeluztncm5pq0ckpm75hztrv7m7nhhh94d",

"inbound_confirmation_blocks": 1,

"inbound_confirmation_seconds": 600,

"max_streaming_quantity": 0,

"memo": "=:ETH.ETH:0x3021c479f7f8c9f1d5c7d8523ba5e22c0bcb5430::thorname:10",

"notes": "First output should be to inbound_address, second output should be change back to self, third output should be OP_RETURN, limited to 80 bytes. Do not send below the dust threshold. Do not use exotic spend scripts, locks or address formats (P2WSH with Bech32 address format preferred).",

"outbound_delay_blocks": 303,

"outbound_delay_seconds": 1818,

"recommended_min_amount_in": "72000",

"slippage_bps": 49,

"streaming_swap_blocks": 0,

"total_swap_seconds": 2418,

"warning": "Do not cache this response. Do not send funds after the expiry."

}

Notice how thorname:10 has been appended to the end of the memo. This instructs THORChain to skim 10 basis points from the swap. The user should still expect to receive the expected_amount_out, meaning the affiliate fee has already been subtracted from this number.

For more information on affiliate fees: fees.md.

Streaming Swaps

Streaming Swaps can be used to break up the trade to reduce slip fees.

Params:

- streaming_interval: # of THORChain blocks between each subswap. Larger # of blocks gives arb bots more time to rebalance pools. For deeper/more active pools a value of

1is most likely okay. For shallower/less active pools a larger value should be considered. - streaming_quantity: # of subswaps to execute. If this value is omitted or set to

0the protocol will calculate the # of subswaps such that each subswap has a slippage of 5 bps.

Memo format:

=:BTC.BTC:<destination_addr>:<limit>/<streaming_interval>/<streaming_quantity>

Quote example:

{

"approx_streaming_savings": 0.99930555,

"dust_threshold": "10000",

"expected_amount_out": "145448080",

"expiry": 1689117597,

"fees": {

"affiliate": "0",

"asset": "ETH.ETH",

"outbound": "480000"

},

"inbound_address": "bc1qk2z8luw2afwuugndynegn72dkv45av5hyjrtm8",

"inbound_confirmation_blocks": 1,

"inbound_confirmation_seconds": 600,

"max_streaming_quantity": 1440,

"memo": "=:ETH.ETH:0x3021c479f7f8c9f1d5c7d8523ba5e22c0bcb5430:0/10/1440",

"notes": "First output should be to inbound_address, second output should be change back to self, third output should be OP_RETURN, limited to 80 bytes. Do not send below the dust threshold. Do not use exotic spend scripts, locks or address formats (P2WSH with Bech32 address format preferred).",

"outbound_delay_blocks": 76,

"outbound_delay_seconds": 456,

"recommended_min_amount_in": "158404",

"slippage_bps": 8176,

"streaming_swap_blocks": 14400,

"streaming_swap_seconds": 86400,

"total_swap_seconds": 87456,

"warning": "Do not cache this response. Do not send funds after the expiry."

}

Notice how approx_streaming_savings shows the savings by using streaming swaps. total_swap_seconds also shows the amount of time the swap will take.

Custom Refund Address

By default, in the case of a refund the protocol will return the inbound swap to the original sender. However, in the case of protocol <> protocol interactions, many times the original sender is a smart contract, and not the user's EOA. In these cases, a custom refund address can be defined in the memo, which will ensure the user will receive the refund and not the smart contract.

Params:

- refund_address: User's refund address. Needs to be a valid address for the inbound asset, otherwise refunds will be returned to the sender

Memo format:

=:BTC.BTC:<destination>/<refund_address>

{

...

"memo": "=:BTC.BTC:bc1qyl7wjm2ldfezgnjk2c78adqlk7dvtm8sd7gn0q/0x3021c479f7f8c9f1d5c7d8523ba5e22c0bcb5430",

...

}

Error Handling

The quote swap endpoint simulates all of the logic of an actual swap transaction. It ships with comprehensive error handling.

.png) This error means the swap cannot be completed given your price tolerance.

.png)

This error ensures the destination address is for the chain specified by to_asset.

.png) This error is due to the fact the affiliate address is too long given the source chain's memo length requirements. Try registering a THORName to shorten the memo.

.png) This error means the requested asset does not exist.

.png)

Bound checks are made on both affiliate_bps and tolerance_bps.

Support

Developers experiencing issues with these APIs can go to the Developer Discord for assistance. Interface developers should subscribe to the #interface-alerts channel for information pertinent to the endpoints and functionality discussed here.

Fees and Wait Times

Fee Types

Users pay up to four kinds of fees when conducting a swap.

- Layer1 Network Fees (gas): paid by the user when sending the asset to THORChain to be swapped. This is controlled by the user's wallet.

- Slip Fee: protects the pool from being manipulated by large swaps. Calculated as a function of transaction size and current pool depth. The slip fee formula is explained here and an example implementation is here.

- Affiliate Fee - (optional) a percentage skimmed from the inbound amount that can be paid to exchanges or wallet providers. Wallets can now accept fees in any THORChain-supported asset (USDC, BTC, etc). Check the "Preferred Asset for Affiliate Fees" section in fees.md for more details and setup information.

- Outbound Fee - the fee the Network pays on behalf of the user to send the outbound transaction. See Outbound Fee.

See the fees section for full details.

Refunds and Minimum Swap Amount

If a transaction fails, it is refunded, thus it will pay the outboundFee for the SourceChain not the DestinationChain. Thus devs should always swap an amount that is a maximum of the following, multiplied by at least a 4x buffer to allow for gas spikes:

- The Destination Chain outboundFee, or

- The Source Chain outboundFee, or

- $1.00 (the minimum outboundFee).

For convenience, a recommended_min_amount_in is included on the Swap Quote endpoint, which is the value described above. This value is priced in the inbound asset of the quote request (in 1e8). This should be the minimum-allowed swap amount for the requested quote.

Wait Times

There are four phases of a transaction sent to THORChain each taking time to complete.

- Layer1 Inbound Confirmation - assuming the inboundTx will be confirmed in the next block, it is the source blockchain block time.

- Observation Counting - time for 67% THORChain Nodes to observe and agree on the inboundTx.

- Confirmation Counting - for non-instant finality blockchains, the amount of time THORChain will wait before processing to protect against double spends and re-org attacks.

- Outbound Delay - dependent on size and network traffic. Large outbounds will be delayed.

- Layer1 Outbound Confirmation - Outbound blockchain block time.

Wait times can be between a few seconds up to an hour. The assets being swapped, the size of the swap and the current network traffic within THORChain will determine the wait time.

See the delays.md section for full details.

Streaming Swaps

Streaming Swaps is a means for a swapper to get better price execution if they are patient. This ensures Capital Efficiency while still keeping with the philosophy "impatient people pay more".

There are two important parts to streaming swaps:

- The interval part of the stream allows arbs enough time to rebalance intra-swap - this means the capital demands of swaps are met throughout, instead of after.

- The quantity part of the stream allows the swapper to reduce the size of their sub-swap so each is executed with less slip (so the total swap will be executed with less slip) without losing capital to on-chain L1 fees.

If a swapper is willing to be patient, they can execute the swap with a better price, by allowing arbs to rebalance the pool between the streaming swaps.

Once all swaps are executed and the streaming swap is completed, the target token is sent to the user (minus outbound fees).

Streaming Swaps is similar to a Time Weighted Average Price (TWAP) trade however it is restricted to 24 hours (Mimir STREAMINGSWAPMAXLENGTH = 14400 blocks).

Using Streaming Swaps

To utilise a streaming swap, use the following within a Memo:

Trade Target or Limit / Swap Interval / Swap Quantity.

- Limit or Trade Target: Uses the trade limit to set the maximum asset ratio at which a mini-swap can occur; otherwise, a refund is issued.

- Interval: Block separation of each swap. For example, a value of 10 means a mini-swap is performed every 10 blocks.

- Quantity: The number of swaps to be conducted. If set to 0, the network will determine the appropriate quantity.

Using the values Limit/10/5 would conduct five mini-swaps with a block separation of 10. Only swaps that achieve the specified asset ratio (defined by Limit) will be performed, while others will result in a refund.

On each swap attempt, the network will track how much (in funds) failed to swap and how much was successful. After all swap attempts are made (specified by "swap quantity"), the network will send out all successfully swapped value, and the remaining source asset via refund (that failed to swap for some reason, most likely due to the trade target).

If the first swap attempt fails for some reason, the entire streaming swap is refunded and no further attempts will be made. If the swap quantity is set to zero, the network will determine the number of swaps on its own with a focus on the lowest fees and maximize the number of trades.

Minimum Swap Size

A min swap size is placed on the network for streaming swaps (Mimir StreamingSwapMinBPFee = 5 Basis Points). This is the minimum slip for each individual swap within a streaming swap allowed. This also puts a cap on the number of swaps in a streaming swap. This allows the network to be more friendly to large trades, while also keeping revenues up for small or medium-sized trades.

Calculate Optimal Swap

The network works out the optimal streaming swap solution based on the Mimumn Swap Size and the swapAmount.

Single Swap: To calculate the minimum swap size for a single swap, you take 2.5 basis points (bps) of the depth of the pool. The formula is as follows:

Example using BTC Pool:

- BTC Rune Depth = 20,007,476 RUNE

- StreamingSwapMinBPFee = 5 bp

MinimumSwapSize = 0.0005 * 20,007,476 = 10,003. RUNE

Double Swap: When dealing with two pools of arbitrary depths and aiming for a precise 5 bps swap fee (set by StreamingSwapMinBPFee), you need to create a virtual pool size called runeDepth using the following formula:

r1 represents the rune depth of pool1, and r2 represents the rune depth of pool2.

The runeDepth is then used with 1.25 bps (half of 2.5 bps since there are two swaps), which gives you the minimum swap size that results in a 5 bps swap fee.

The larger the difference between the pools, the more the virtual pool skews towards the smaller pool. This results in less rewards given to the larger pool, and more rewards given to the smaller pool.

Example using BTC and ETH Pool

- BTC Rune Depth = 20,007,476 RUNE

- ETH Rune Depth = 8,870,648 RUNE

- StreamingSwapMinBPFee = 5 bp

virtualRuneDepth = (2*20,007,476*8,870,648) / (20,007,476 + 8,870,648) = 12,291,607 RUNE

MinimumSwapSize = (0.0005/4) * 12,291,607 = 1536.45 RUNE

Swap Count

The number of swaps required is determined by dividing the swap Amount by the minimum swap size calculated in the previous step.

The swapAmount represents the total amount to be swapped.

Example: swap 20,000 RUNE worth of BTC to ETH. (approx 0.653 BTC).

20,000 / 3,072.90 = 6.5 = 7 Swaps.

Comparing Price Execution

The difference between streaming swaps and non-streaming swaps can be calculated using the swap count with the following formula:

The differencevalue represents the percentage of the swap fee saved compared to doing the same swap with a regular fee structure. There higher the swapCount, the bigger the difference.

Example:

- (7-1)/7 = 6/7 = 85% better price execution by being patient.

Quick Start Guide

Lending allows users to deposit native collateral, and then create a debt at a collateralization ratio CR (collateralization ratio). The debt is always denominated in USD (aka TOR) regardless of what L1 asset the user receives.

Streaming swaps is enabled for lending.

Open a Loan Quote

Lending Quote endpoints have been created to simplify the implementation process.

Request: Loan quote using 1 BTC as collateral, target debt asset is USDT at 0XDAC17F958D2EE523A2206206994597C13D831EC7

Response:

{

"dust_threshold": "10000",

"expected_amount_out": "112302802900",

"expected_collateral_deposited": "9997829",

"expected_collateralization_ratio": "31467",

"expected_debt_issued": "112887730000",

"expiry": 1698901398,

"fees": {

"asset": "ETH.USDT-0XDAC17F958D2EE523A2206206994597C13D831EC7",

"liquidity": "114988700",

"outbound": "444599700",

"slippage_bps": 10,

"total": "559588400",

"total_bps": 49

},

"inbound_address": "bc1qmed4v5am2hcg8furkeff2pczdnt0qu4flke420",

"inbound_confirmation_blocks": 1,

"inbound_confirmation_seconds": 600,

"memo": "$+:ETH.USDT:0xe7062003a7be4df3a86127293a0d6b1f54c04220",

"notes": "First output should be to inbound_address, second output should be change back to self, third output should be OP_RETURN, limited to 80 bytes. Do not send below the dust threshold. Do not use exotic spend scripts, locks or address formats (P2WSH with Bech32 address format preferred).",

"outbound_delay_blocks": 3,

"outbound_delay_seconds": 18,

"recommended_min_amount_in": "156000",

"warning": "Do not cache this response. Do not send funds after the expiry."

}

If you send 1 BTC to bc1q2hldv0pmy9mcpddj2qrvdgcx6pw6h6h7gqytwy with the memo $+:ETH.USDT:0xe7062003a7be4df3a86127293a0d6b1f54c04220 you will receive approx. 1128.8773 USDT debt sent to 0xe7062003a7be4df3a86127293a0d6b1f54c04220 with a CR of 314.6% and will incur 49 basis points (0.49%) slippage.

Loans cannot be repaid until a minimum time has passed, as determined by LOANREPAYMENTMATURITY, which is currently set as the current block height plus LOANREPAYMENTMATURITY. Currently, LOANREPAYMENTMATURITY is set to 432,000 blocks, equivalent to 30 days. Increasing the collateral on an existing loan to obtain additional debit resets the period.

Close a Loan

Request: Repay a loan using USDT where BTC.BTC was used as colloteral. Note any asset can be used to repay a loan. https://thornode.ninerealms.com/thorchain/quote/loan/close?from_asset=BTC.BTC&amount=114947930000&to_asset=BTC.BTC&loan_owner=bc1q089j003xwj07uuavt2as5r45a95k5zzrhe4ac3

Response:

{

"dust_threshold": "10000",

"expected_amount_out": "9985158",

"expected_collateral_withdrawn": "9997123",

"expected_debt_repaid": "390985054444080",

"expiry": 1698897875,

"fees": {

"asset": "BTC.BTC",

"liquidity": "38196994221",

"outbound": "7500",

"slippage_bps": 4347,

"total": "38197001721",

"total_bps": 38253777

},

"inbound_address": "bc1q69vcdslg0vfy4ne3nj7te5p9cvu2y4vq8t3x99",

"inbound_confirmation_blocks": 192,

"inbound_confirmation_seconds": 115200,

"memo": "$-:BTC.BTC:bc1q089j003xwj07uuavt2as5r45a95k5zzrhe4ac3",

"notes": "First output should be to inbound_address, second output should be change back to self, third output should be OP_RETURN, limited to 80 bytes. Do not send below the dust threshold. Do not use exotic spend scripts, locks or address formats (P2WSH with Bech32 address format preferred).",

"outbound_delay_blocks": 12,

"outbound_delay_seconds": 72,

"recommended_min_amount_in": "30000",

"warning": "Do not cache this response. Do not send funds after the expiry."

}

If you send 1149.47 USDT with a memo $-:BTC.BTC:bc1q089j003xwj07uuavt2as5r45a95k5zzrhe4ac3 of you will repay your loan down.

Borrowers Position

Request:

Get brower's positin in the BTC pool who tool out a loan from bc1q089j003xwj07uuavt2as5r45a95k5zzrhe4ac3

https://thornode.ninerealms.com/thorchain/pool/BTC.BTC/borrower/bc1q089j003xwj07uuavt2as5r45a95k5zzrhe4ac3\

Response:

{

"asset": "BTC.BTC",

"collateral_current": "9997123",

"collateral_deposited": "9997123",

"collateral_withdrawn": "0",

"debt_current": "114947930000",

"debt_issued": "114947930000",

"debt_repaid": "0",

"last_open_height": 12252923,

"last_repay_height": 0,

"owner": "bc1q089j003xwj07uuavt2as5r45a95k5zzrhe4ac3"

}

The borrower has provided 0.0997 BTC and has a current TOR debt of $1149.78. No repayments have been yet.

Support

Developers experiencing issues with these APIs can go to the Developer Discord for assistance. Interface developers should subscribe to the #interface-alerts channel for information pertinent to the endpoints and functionality discussed here.

Quick Start Guide

Lending allows users to deposit native collateral, and then create a debt at a collateralization ratio CR (collateralization ratio). The debt is always denominated in USD (aka TOR) regardless of what L1 asset the user receives.

Streaming swaps is enabled for lending.

Open a Loan Quote

Lending Quote endpoints have been created to simplify the implementation process.

Request: Loan quote using 1 BTC as collateral, target debt asset is USDT at 0XDAC17F958D2EE523A2206206994597C13D831EC7

Response:

{

"dust_threshold": "10000",

"expected_amount_out": "112302802900",

"expected_collateral_deposited": "9997829",

"expected_collateralization_ratio": "31467",

"expected_debt_issued": "112887730000",

"expiry": 1698901398,

"fees": {

"asset": "ETH.USDT-0XDAC17F958D2EE523A2206206994597C13D831EC7",

"liquidity": "114988700",

"outbound": "444599700",

"slippage_bps": 10,

"total": "559588400",

"total_bps": 49

},

"inbound_address": "bc1qmed4v5am2hcg8furkeff2pczdnt0qu4flke420",

"inbound_confirmation_blocks": 1,

"inbound_confirmation_seconds": 600,

"memo": "$+:ETH.USDT:0xe7062003a7be4df3a86127293a0d6b1f54c04220",

"notes": "First output should be to inbound_address, second output should be change back to self, third output should be OP_RETURN, limited to 80 bytes. Do not send below the dust threshold. Do not use exotic spend scripts, locks or address formats (P2WSH with Bech32 address format preferred).",

"outbound_delay_blocks": 3,

"outbound_delay_seconds": 18,

"recommended_min_amount_in": "156000",

"warning": "Do not cache this response. Do not send funds after the expiry."

}

If you send 1 BTC to bc1q2hldv0pmy9mcpddj2qrvdgcx6pw6h6h7gqytwy with the memo $+:ETH.USDT:0xe7062003a7be4df3a86127293a0d6b1f54c04220 you will receive approx. 1128.8773 USDT debt sent to 0xe7062003a7be4df3a86127293a0d6b1f54c04220 with a CR of 314.6% and will incur 49 basis points (0.49%) slippage.

Loans cannot be repaid until a minimum time has passed, as determined by LOANREPAYMENTMATURITY, which is currently set as the current block height plus LOANREPAYMENTMATURITY. Currently, LOANREPAYMENTMATURITY is set to 432,000 blocks, equivalent to 30 days. Increasing the collateral on an existing loan to obtain additional debit resets the period.

Close a Loan

Request: Repay a loan using USDT where BTC.BTC was used as colloteral. Note any asset can be used to repay a loan. https://thornode.ninerealms.com/thorchain/quote/loan/close?from_asset=BTC.BTC&amount=114947930000&to_asset=BTC.BTC&loan_owner=bc1q089j003xwj07uuavt2as5r45a95k5zzrhe4ac3

Response:

{

"dust_threshold": "10000",

"expected_amount_out": "9985158",

"expected_collateral_withdrawn": "9997123",

"expected_debt_repaid": "390985054444080",

"expiry": 1698897875,

"fees": {

"asset": "BTC.BTC",

"liquidity": "38196994221",

"outbound": "7500",

"slippage_bps": 4347,

"total": "38197001721",

"total_bps": 38253777

},

"inbound_address": "bc1q69vcdslg0vfy4ne3nj7te5p9cvu2y4vq8t3x99",

"inbound_confirmation_blocks": 192,

"inbound_confirmation_seconds": 115200,

"memo": "$-:BTC.BTC:bc1q089j003xwj07uuavt2as5r45a95k5zzrhe4ac3",

"notes": "First output should be to inbound_address, second output should be change back to self, third output should be OP_RETURN, limited to 80 bytes. Do not send below the dust threshold. Do not use exotic spend scripts, locks or address formats (P2WSH with Bech32 address format preferred).",

"outbound_delay_blocks": 12,

"outbound_delay_seconds": 72,

"recommended_min_amount_in": "30000",

"warning": "Do not cache this response. Do not send funds after the expiry."

}

If you send 1149.47 USDT with a memo $-:BTC.BTC:bc1q089j003xwj07uuavt2as5r45a95k5zzrhe4ac3 of you will repay your loan down.

Borrowers Position

Request:

Get brower's positin in the BTC pool who tool out a loan from bc1q089j003xwj07uuavt2as5r45a95k5zzrhe4ac3

https://thornode.ninerealms.com/thorchain/pool/BTC.BTC/borrower/bc1q089j003xwj07uuavt2as5r45a95k5zzrhe4ac3\

Response:

{

"asset": "BTC.BTC",

"collateral_current": "9997123",

"collateral_deposited": "9997123",

"collateral_withdrawn": "0",

"debt_current": "114947930000",

"debt_issued": "114947930000",

"debt_repaid": "0",

"last_open_height": 12252923,

"last_repay_height": 0,

"owner": "bc1q089j003xwj07uuavt2as5r45a95k5zzrhe4ac3"

}

The borrower has provided 0.0997 BTC and has a current TOR debt of $1149.78. No repayments have been yet.

Support

Developers experiencing issues with these APIs can go to the Developer Discord for assistance. Interface developers should subscribe to the #interface-alerts channel for information pertinent to the endpoints and functionality discussed here.

Quickstart Guide

Introduction

THORChain allows users to deposit Layer1 assets into its network to earn asset-denominated yield without RUNE asset exposure, or being aware of THORChain’s network.

There is no permission, authentication or prior steps, so developers can get started and allow their users to earn asset-denominated yield simply by sending layer1 transactions to THORChain vaults.

Under the hood, THORChain deposits the user’s Layer1 asset into a liquidity pool which earns yield. This yield is tracked and paid to the user’s deposit value. Users can withdraw their Layer1 asset, including the yield earned. There is no slashing, penalties, timelocks, or account minimum/maximums. The only fees paid are the Layer1 fees to make a deposit and withdraw transaction (as necessitated), and a slip-based fee on entry and exit to stop price manipulation attacks. Both of these are transparent and within the user’s control.

Streaming swaps is enabled for savers.

Quote for a Savers Quote

Savers Quote endpoints have been created to simplify the implementation process.

Add 1 BTC to Savers.

Request: Add 1 BTC to Savers

https://thornode.ninerealms.com/thorchain/quote/saver/deposit?asset=BTC.BTC&amount=100000000

Response:

{

"dust_threshold": "10000",

"expected_amount_deposit": "99932291",

"expected_amount_out": "99932291",

"expiry": 1700263119,

"fees": {

"affiliate": "0",

"asset": "BTC/BTC",

"liquidity": "67672",

"outbound": "355",

"slippage_bps": 6,

"total": "68027",

"total_bps": 6

},

"inbound_address": "bc1qe7lfmet2l5j7ypsd6ln300jt8mg3dt2q3darj8",

"inbound_confirmation_blocks": 1,

"inbound_confirmation_seconds": 600,

"memo": "+:BTC/BTC",

"notes": "First output should be to inbound_address, second output should be change back to self, third output should be OP_RETURN, limited to 80 bytes. Do not send below the dust threshold. Do not use exotic spend scripts, locks or address formats (P2WSH with Bech32 address format preferred).",

"recommended_min_amount_in": "10000",

"slippage_bps": 13,

"warning": "Do not cache this response. Do not send funds after the expiry."

}

If you send 1 BTC to bc1quuf5sr444km2zlgrg654mjdfgkuzayfs7nqrfmwith the memo +:BTC/BTC, you can expect 0.99932 BTC will and will incur 13 basis points (0.13%) of slippage.

Inbound transactions should not be delayed for any reason else there is risk funds will be sent to an unreachable address. Use standard transactions, check the inbound address before sending and use the recommended gas rate to ensure transactions are confirmed in the next block to the latest Inbound_Address.

For security reasons, your inbound transaction will be delayed by 1 BTC Block.

Full quote saving endpoint specification can be found here: https://thornode.ninerealms.com/thorchain/doc/.

See an example implementation here.

User withdrawing all of their BTC Saver's position.

Request: Withdraw 100% of BTC Savers for bc1qy9rjlz5w3tqn7m3reh3y48n8del4y8z42sswx5

Response:

{

"dust_amount": "20000",

"dust_threshold": "10000",

"expected_amount_out": "297234276",

"expiry": 1698901306,

"fees": {

"affiliate": "0",

"asset": "BTC.BTC",

"liquidity": "150576",

"outbound": "39000",

"slippage_bps": 5,

"total": "189576",

"total_bps": 6

},

"inbound_address": "bc1qmed4v5am2hcg8furkeff2pczdnt0qu4flke420",

"memo": "-:BTC/BTC:10000",

"notes": "First output should be to inbound_address, second output should be change back to self, third output should be OP_RETURN, limited to 80 bytes. Do not send below the dust threshold. Do not use exotic spend scripts, locks or address formats (P2WSH with Bech32 address format preferred).",

"outbound_delay_blocks": 548,

"outbound_delay_seconds": 3288,

"slippage_bps": 60,

"warning": "Do not cache this response. Do not send funds after the expiry."

}

Deposit and withdraw interfaces will return inbound_address and memo fields that can be used to construct the transaction. Do not cache theinbound_address field!

Basic Mechanics

Users can add assets to a vault by sending assets directly to the chain’s vault address found on the /thorchain/inbound_addresses endpoint. Quote endpoints will also return this.

1. Find the L1 vault address

https://thornode.ninerealms.com/thorchain/inbound_addresses

Example:

curl -SL https://thornode.ninerealms.com/thorchain/inbound_addresses | jq '.[] | select(.chain == "BTC") | .address'

=> “bc1q556ljv5y4rkdt4p46usx86esljs3xqjxyntlyd”

2. Determine if there is capacity available to mint new synths

There is a cap on how many synths can be minted as a function of liquidity depth. To do this, find synth_mint_paused = false on the /pool endpoint

curl -SL https://thornode.ninerealms.com/thorchain/pools | jq '.[] | select(.asset == "BTC.BTC") | .synth_mint_paused'

3. Send memoless savers transactions

Both Saver Deposit and Withdraw transactions can be done without memos (optional memos can be included if a wallet wishes, see Transaction Memos, since there is a marginal transaction cost savings to including memos).

To deposit, users should send any amount of asset they wish (avoiding dust amounts). The network will read the deposit and user address, then add them into the Saver Vault automatically.

To withdraw, the user should send a specific dust amount of asset (avoiding the dust threshold), from an amount 0 units above the dust threshold, to an amount 10,000 units above the threshold.

10000 units is read as “withdraw 10000 basis points”, which is 100%.

The dust threshold is the point at which the network will ignore the amount sent to stop dust attacks (widely seen on UTXO chains).

Specific rules for each chain and action are as follows:

- Each chain has a defined

dust_thresholdin base units - For asset amounts in the range:

[ dust_threshold + 1 : dust_threshold + 10,000], the network will withdrawdust_threshold - 10,000basis points from the user’s Savers position - For asset amounts greater than

dust_threshold + 10,000, the network will add to the user’s Savers position

The dust_threshold for each chain are defined as:

- BTC: 10,000 sats

- BCH: 10,000 sats

- LTC: 10,000 sats

- DOGE: 100,000,000 sats

- ETH,AVAX: 0 wei

- ATOM: 0 uatom

- BNB: 0 nbnb

Transactions with asset amounts equal to or below the dust_threshold for the chain will be ignored to prevent dust attacks. Ensure you are converting the “human readable” amount (1 BTC) to the correct gas units (100,000,000 sats)

Examples:

- User wants to deposit 100,000 sats (0.001 BTC): Wallet signs an inbound tx to THORChain’s BTC

/inbound_addressesvault address from the user with 100,000 sats. This will be added to the user’s Savers position. - User wants to withdraw 50% of their BTC Savers position: Wallet signs an inbound with 15,000 sats

50% = 5,000 basis points + 10,000[BTC dust_thresholdto THORChain’s BTC vault - User wants to withdraw 10% of their ETH Savers position: Wallet signs an inbound with 1,000 wei

(10% = 1,000 basis points + 0 [ETH dust_threshold])to THORChain’s ETH vault - User wants to deposit 10,000 sats to their DOGE Savers position: Not possible transactions below the

dust_thresholdfor each chain are ignored to prevent dust attacks. - User wants to deposit 20,000 sats to their BTC Savers position: Not possible with memoless, the user’s deposit will be interpreted as a

withdraw:100%. Instead the user should use a memo.

translates to: “withdraw 10,000 basis points, or 100% of address’ savings.

Historical Data & Performance

An important consideration for UIs when implementing this feature is how to display:

- an address’ present performance (targeted at retaining current savers)

- past performance of savings vaults (targeted at attracting potential savers)

Present Performance

A user is likely to want to know the following things:

- What is the redeemable value of my share in the Savings Vault?

- What is the absolute amount and % yield I have earned to date on my stake?

The latter can be derived from the former.

yield_percent = (1 - (depositValue / redeemableValue)) * 100

saver’s address: bc1qcxssye4j6730h7ehgega3gyykkuwgdgmmpu62n

myUnits => curl -SL https://thornode.ninerealms.com/thorchain/pool/BTC.BTC/savers | jq '.[] | select(.asset_address == "bc1qcxssye4j6730h7ehgega3gyykkuwgdgmmpu62n") | .units'

saverUnits => curl -SL https://thornode.ninerealms.com/thorchain/pools | jq '.[] | select(.asset == "BTC.BTC") | .savers_units'

saverDepth => curl -SL https://thornode.ninerealms.com/thorchain/pools | jq '.[] | select(.asset == "BTC.BTC") | .savers_depth'

Past Performance

The easy way to determine lifetime performance of the savers vault is to look back 7 days, find the saver value, then compare it with the current saver value.

Example code:\

https://thornode.ninerealms.com/thorchain/pool/BTC.BTC/savers will show all BTC Savers

Support

Developers experiencing issues with these APIs can go to the Developer Discord for assistance. Interface developers should subscribe to the #interface-alerts channel for information pertinent to the endpoints and functionality discussed here.

Quickstart Guide

Introduction

THORChain allows users to deposit Layer1 assets into its network to earn asset-denominated yield without RUNE asset exposure, or being aware of THORChain’s network.

There is no permission, authentication or prior steps, so developers can get started and allow their users to earn asset-denominated yield simply by sending layer1 transactions to THORChain vaults.

Under the hood, THORChain deposits the user’s Layer1 asset into a liquidity pool which earns yield. This yield is tracked and paid to the user’s deposit value. Users can withdraw their Layer1 asset, including the yield earned. There is no slashing, penalties, timelocks, or account minimum/maximums. The only fees paid are the Layer1 fees to make a deposit and withdraw transaction (as necessitated), and a slip-based fee on entry and exit to stop price manipulation attacks. Both of these are transparent and within the user’s control.

Streaming swaps is enabled for savers.

Quote for a Savers Quote

Savers Quote endpoints have been created to simplify the implementation process.

Add 1 BTC to Savers.

Request: Add 1 BTC to Savers

https://thornode.ninerealms.com/thorchain/quote/saver/deposit?asset=BTC.BTC&amount=100000000

Response:

{

"dust_threshold": "10000",

"expected_amount_deposit": "99932291",

"expected_amount_out": "99932291",

"expiry": 1700263119,

"fees": {

"affiliate": "0",

"asset": "BTC/BTC",

"liquidity": "67672",

"outbound": "355",

"slippage_bps": 6,

"total": "68027",

"total_bps": 6

},

"inbound_address": "bc1qe7lfmet2l5j7ypsd6ln300jt8mg3dt2q3darj8",

"inbound_confirmation_blocks": 1,

"inbound_confirmation_seconds": 600,

"memo": "+:BTC/BTC",

"notes": "First output should be to inbound_address, second output should be change back to self, third output should be OP_RETURN, limited to 80 bytes. Do not send below the dust threshold. Do not use exotic spend scripts, locks or address formats (P2WSH with Bech32 address format preferred).",

"recommended_min_amount_in": "10000",

"slippage_bps": 13,

"warning": "Do not cache this response. Do not send funds after the expiry."

}

If you send 1 BTC to bc1quuf5sr444km2zlgrg654mjdfgkuzayfs7nqrfmwith the memo +:BTC/BTC, you can expect 0.99932 BTC will and will incur 13 basis points (0.13%) of slippage.

Inbound transactions should not be delayed for any reason else there is risk funds will be sent to an unreachable address. Use standard transactions, check the inbound address before sending and use the recommended gas rate to ensure transactions are confirmed in the next block to the latest Inbound_Address.

For security reasons, your inbound transaction will be delayed by 1 BTC Block.

Full quote saving endpoint specification can be found here: https://thornode.ninerealms.com/thorchain/doc/.

See an example implementation here.

User withdrawing all of their BTC Saver's position.

Request: Withdraw 100% of BTC Savers for bc1qy9rjlz5w3tqn7m3reh3y48n8del4y8z42sswx5

Response:

{

"dust_amount": "20000",

"dust_threshold": "10000",

"expected_amount_out": "297234276",

"expiry": 1698901306,

"fees": {

"affiliate": "0",

"asset": "BTC.BTC",

"liquidity": "150576",

"outbound": "39000",

"slippage_bps": 5,

"total": "189576",

"total_bps": 6

},

"inbound_address": "bc1qmed4v5am2hcg8furkeff2pczdnt0qu4flke420",

"memo": "-:BTC/BTC:10000",

"notes": "First output should be to inbound_address, second output should be change back to self, third output should be OP_RETURN, limited to 80 bytes. Do not send below the dust threshold. Do not use exotic spend scripts, locks or address formats (P2WSH with Bech32 address format preferred).",

"outbound_delay_blocks": 548,

"outbound_delay_seconds": 3288,

"slippage_bps": 60,

"warning": "Do not cache this response. Do not send funds after the expiry."

}

Deposit and withdraw interfaces will return inbound_address and memo fields that can be used to construct the transaction. Do not cache theinbound_address field!

Basic Mechanics

Users can add assets to a vault by sending assets directly to the chain’s vault address found on the /thorchain/inbound_addresses endpoint. Quote endpoints will also return this.

1. Find the L1 vault address

https://thornode.ninerealms.com/thorchain/inbound_addresses

Example:

curl -SL https://thornode.ninerealms.com/thorchain/inbound_addresses | jq '.[] | select(.chain == "BTC") | .address'

=> “bc1q556ljv5y4rkdt4p46usx86esljs3xqjxyntlyd”

2. Determine if there is capacity available to mint new synths

There is a cap on how many synths can be minted as a function of liquidity depth. To do this, find synth_mint_paused = false on the /pool endpoint

curl -SL https://thornode.ninerealms.com/thorchain/pools | jq '.[] | select(.asset == "BTC.BTC") | .synth_mint_paused'

3. Send memoless savers transactions

Both Saver Deposit and Withdraw transactions can be done without memos (optional memos can be included if a wallet wishes, see Transaction Memos, since there is a marginal transaction cost savings to including memos).

To deposit, users should send any amount of asset they wish (avoiding dust amounts). The network will read the deposit and user address, then add them into the Saver Vault automatically.

To withdraw, the user should send a specific dust amount of asset (avoiding the dust threshold), from an amount 0 units above the dust threshold, to an amount 10,000 units above the threshold.

10000 units is read as “withdraw 10000 basis points”, which is 100%.

The dust threshold is the point at which the network will ignore the amount sent to stop dust attacks (widely seen on UTXO chains).

Specific rules for each chain and action are as follows:

- Each chain has a defined

dust_thresholdin base units - For asset amounts in the range:

[ dust_threshold + 1 : dust_threshold + 10,000], the network will withdrawdust_threshold - 10,000basis points from the user’s Savers position - For asset amounts greater than

dust_threshold + 10,000, the network will add to the user’s Savers position

The dust_threshold for each chain are defined as:

- BTC: 10,000 sats

- BCH: 10,000 sats

- LTC: 10,000 sats

- DOGE: 100,000,000 sats

- ETH,AVAX: 0 wei

- ATOM: 0 uatom

- BNB: 0 nbnb

Transactions with asset amounts equal to or below the dust_threshold for the chain will be ignored to prevent dust attacks. Ensure you are converting the “human readable” amount (1 BTC) to the correct gas units (100,000,000 sats)

Examples:

- User wants to deposit 100,000 sats (0.001 BTC): Wallet signs an inbound tx to THORChain’s BTC

/inbound_addressesvault address from the user with 100,000 sats. This will be added to the user’s Savers position. - User wants to withdraw 50% of their BTC Savers position: Wallet signs an inbound with 15,000 sats

50% = 5,000 basis points + 10,000[BTC dust_thresholdto THORChain’s BTC vault - User wants to withdraw 10% of their ETH Savers position: Wallet signs an inbound with 1,000 wei

(10% = 1,000 basis points + 0 [ETH dust_threshold])to THORChain’s ETH vault - User wants to deposit 10,000 sats to their DOGE Savers position: Not possible transactions below the

dust_thresholdfor each chain are ignored to prevent dust attacks. - User wants to deposit 20,000 sats to their BTC Savers position: Not possible with memoless, the user’s deposit will be interpreted as a

withdraw:100%. Instead the user should use a memo.

translates to: “withdraw 10,000 basis points, or 100% of address’ savings.

Historical Data & Performance

An important consideration for UIs when implementing this feature is how to display:

- an address’ present performance (targeted at retaining current savers)

- past performance of savings vaults (targeted at attracting potential savers)

Present Performance

A user is likely to want to know the following things:

- What is the redeemable value of my share in the Savings Vault?

- What is the absolute amount and % yield I have earned to date on my stake?

The latter can be derived from the former.

yield_percent = (1 - (depositValue / redeemableValue)) * 100

saver’s address: bc1qcxssye4j6730h7ehgega3gyykkuwgdgmmpu62n

myUnits => curl -SL https://thornode.ninerealms.com/thorchain/pool/BTC.BTC/savers | jq '.[] | select(.asset_address == "bc1qcxssye4j6730h7ehgega3gyykkuwgdgmmpu62n") | .units'

saverUnits => curl -SL https://thornode.ninerealms.com/thorchain/pools | jq '.[] | select(.asset == "BTC.BTC") | .savers_units'

saverDepth => curl -SL https://thornode.ninerealms.com/thorchain/pools | jq '.[] | select(.asset == "BTC.BTC") | .savers_depth'

Past Performance

The easy way to determine lifetime performance of the savers vault is to look back 7 days, find the saver value, then compare it with the current saver value.

Example code:\

https://thornode.ninerealms.com/thorchain/pool/BTC.BTC/savers will show all BTC Savers

Support

Developers experiencing issues with these APIs can go to the Developer Discord for assistance. Interface developers should subscribe to the #interface-alerts channel for information pertinent to the endpoints and functionality discussed here.

Fees and Wait Times

Fees

Users pay two kinds of fees when entering or exiting Savings Vaults:

- Layer1 Network Fees (gas): paid by the user when depositing or paid by the network when withdrawing and subtracted from the user's redemption value.

- Slip Fees: protects the pool from being manipulated by large deposits/withdraws. Calculated as a function of transaction size and current pool depth.

The following are required to determine approximate deposit / withdrawal fees:

outboundFee = curl -SL https://thornode.ninerealms.com/thorchain/inbound_addresses | jq '.[] | select(.chain == "BTC") | .outbound_fee'

=> 30000

poolDepth = curl -SL https://thornode.ninerealms.com/thorchain/pools | jq '.[] | select(.asset == "BTC.BTC") | .balance_asset'

=> 68352710830 => 683.5 BTC

Deposit Fees

Example: user is depositing 1.0 BTC into the network, which has 1000 BTC in the pool, with 30k sats outboundFee.

The user will pay ~1/3rd of the THORChain's outbound fee to send assets to Savings Vault, using their typical wallet fee settings (note, this is an estimate only).

totalFee = networkFee + liquidityFee

networkFee = 0.33 * outboundFee = 10,000 sats

liquidityFee = depositAmount / (depositAmount + poolDepth) * depositAmount

liquidityFee = 1.0 / (1.0+10000) * 1.0 = 99000 sats

total fee = 109,000 sats

Withdrawal Fees

Example: user is withdrawing 1.1 BTC from the network, which has 1000 BTC in the pool, with 30k outboundFee.

totalFee = networkFee + liquidityFee

networkFee = outboundFee = 30,000 sats

liquidityFee = withdrawAmount / (withdrawAmount + poolDepth) * withdrawAmount

liquidityFee = 1.1 / (1.1 + 1001.1) * 1.1 = 120,734 sats

total fee = 150,734 sats

Remember, the liquidityFee is entirely dependent on the size of the transaction the user is wishing to do. They may wish to do smaller transactions over a period of time to reduce fees.

Wait Times

When depositing, there are three phases to the transaction.

- Layer1 Inbound Confirmation - assuming the inbound Tx will be confirmed in the next block, it is the source blockchain block time.

- Observation Counting - time for 67% THORChain Nodes to observe and agree on the inbound Tx.

- Confirmation Counting - for non-instant finality blockchains, the amount of time THORChain will wait before processing to protect against double spends and re-org attacks.

When withdrawing using the dust threshold, there are three phases to the transaction

- Layer1 Inbound Confirmation - assuming the inbound Tx will be confirmed in the next block, it is the source blockchain block time.

- Observation Counting - time for 67% THORChain Nodes to observe and agree on the inbound Tx.

- Outbound Delay - dependent on size and network traffic. Large outbounds will be delayed.

- Layer1 Outbound Confirmation - Outbound blockchain block time.

Wait times can be between a few seconds up to an hour. The assets being swapped, the size of the swap and the current network traffic within THORChain will determine the wait time

See the delays.md section for full details.

THORName Guide

Summary

THORNames are THORChain's vanity address system that allows affiliates to collect fees and track their user's transactions. THORNames exist on the THORChain L1, so you will need a THORChain address and $RUNE to create and manage a THORName.;

THORNames have the following properties:

- Name: The THORName's string. Between 1-30 hexadecimal characters and

-_+special characters.; - Owner: This is the THORChain address that owns the THORName

- Aliases: THORNames can have an alias address for any external chain supported by THORChain, and can have an alias for the THORChain L1 that is different than the owner.

- Expiry: THORChain Block-height at which the THORName expires.

- Preferred Asset: The asset to pay out affiliate fees in. This can be any asset supported by THORChain.;

Create a THORName

THORNames are created by posting a MsgDeposit to the THORChain network with the appropriate memo and enough $RUNE to cover the registration fee and to pay for the amount of blocks the THORName should be registered for.;

- Registration fee:

tns_register_fee_runeon the Network endpoint. This value is in 1e8, so100000000 = 1 $RUNE - Per block fee:

tns_fee_per_block_runeon the same endpoint, also in 1e8.;

For example, for a new THORName to be registered for 10 years the amount paid would be:

amt = tns_register_fee_rune + tns_fee_per_block_rune * 10 * 5256000

5256000 = avg # of blocks per year

The expiration of the THORName will automatically be set to the number of blocks in the future that was paid for minus the registration fee.

Memo Format:

Memo template is: ~:name:chain:address:?owner:?preferredAsset:?expiry

- name: Your THORName. Must be unique, between 1-30 characters, hexadecimal and

-_+special characters.; - chain: The chain of the alias to set.;

- address: The alias address. Must be an address of chain.

- owner: THORChain address of owner (optional).

- preferredAsset: Asset to receive fees in. Must be supported be an active pool on THORChain. Value should be

assetproperty from the Pools endpoint.;

This will register a new THORName called ODIN with a Bitcoin alias of bc1Address owner of thorAddress and preferred asset of BTC.BTC.

You can use Asgardex to post a MsgDeposit with a custom memo. Load your wallet, then open your THORChain wallet page > Deposit > Custom.;

View your THORName's configuration at the THORName endpoint:

e.g. https://thornode.ninerealms.com/thorchain/thorname/{name}

Renewing your THORName

All THORName's have a expiration represented by a THORChain block-height. Once the expiration block-height has passed, another THORChain address can claim the THORName and any associated balance in the Affiliate Fee Collector Module (Read #preferred-asset-for-affiliate-fees), so it's important to monitor this and renew your THORName as needed.;

To keep your THORName registered you can extend the registration period (move back the expiration block height), by posting a MsgDeposit with the correct THORName memo and $RUNE amount.;

Memo:

~:ODIN:THOR:<thor-alias-address>

(Chain and alias address are required, so just use current values to keep alias unchanged).

$RUNE Amount:

rune_amt = num_blocks_to_extend * tns_fee_per_block

(Remember this value will be in 1e8, so adjust accordingly for your transaction).

Preferred Asset for Affiliate Fees

Starting in THORNode V116, affiliates can collect their fees in the asset of their choice (choosing from the assets that have a pool on THORChain). In order to collect fees in a preferred asset, affiliates must use a THORName in their swap memos.;

How it Works

If an affiliate's THORName has the proper preferred asset configuration set, the network will begin collecting their affiliate fees in $RUNE in the AffiliateCollector module. Once the accrued RUNE in the module is greater than PreferredAssetOutboundFeeMultiplier* outbound_fee of the preferred asset's chain, the network initiates a swap from $RUNE -> Preferred Asset on behalf of the affiliate. At the time of writing, PreferredAssetOutboundFeeMultiplier is set to 100, so the preferred asset swap happens when the outbound fee is 1% of the accrued $RUNE.;

Configuring a Preferred Asset for a THORName:

- Register your THORName following instructions above.

- Set your preferred asset's chain alias (the address you'll be paid out to), and your preferred asset. Note: your preferred asset must be currently supported by THORChain.

For example, if you wanted to be paid out in USDC you would:

-

Grab the full USDC name from the Pools endpoint:

ETH.USDC-0XA0B86991C6218B36C1D19D4A2E9EB0CE3606EB48 -

Post a

MsgDepositto the THORChain network with the appropriate memo to register your THORName, set your preferred asset as USDC, and set your Ethereum network address alias. Assuming the following info:- THORChain address:

thor1dl7un46w7l7f3ewrnrm6nq58nerjtp0dradjtd - THORName:

ac-test - ETH payout address:

0x6621d872f17109d6601c49edba526ebcfd332d5d;

The full memo would look like:

~:ac-test:ETH:0x6621d872f17109d6601c49edba526ebcfd332d5d:thor1dl7un46w7l7f3ewrnrm6nq58nerjtp0dradjtd:ETH.USDC-0XA0B86991C6218B36C1D19D4A2E9EB0CE3606EB48 - THORChain address:

You will also need a THOR alias set to collect affiliate fees. Use another MsgDeposit with memo: ~:<thorname>:THOR:<thorchain-address> to set your THOR alias. Your THOR alias address can be the same as your owner address, but won't be used for anything if a preferred asset is set.;

Once you successfully post your MsgDeposit you can verify that your THORName is configured properly. View your THORName info from THORNode at the following endpoint:

https://thornode.ninerealms.com/thorchain/thorname/ac-test

The response should look like:

{

"affiliate_collector_rune": "0",

"aliases": [

{

"address": "0x6621d872f17109d6601c49edba526ebcfd332d5d",

"chain": "ETH"

},

{

"address": "thor1dl7un46w7l7f3ewrnrm6nq58nerjtp0dradjtd",

"chain": "THOR"

}

],

"expire_block_height": 22061405,

"name": "ac-test",

"owner": "thor1dl7un46w7l7f3ewrnrm6nq58nerjtp0dradjtd",

"preferred_asset": "ETH.USDC-0XA0B86991C6218B36C1D19D4A2E9EB0CE3606EB48"

}

Your THORName is now properly configured and any affiliate fees will begin accruing in the AffiliateCollector module. You can verify that fees are being collected by checking the affiliate_collector_rune value of the above endpoint.

THORName Guide

Summary

THORNames are THORChain's vanity address system that allows affiliates to collect fees and track their user's transactions. THORNames exist on the THORChain L1, so you will need a THORChain address and $RUNE to create and manage a THORName.;

THORNames have the following properties:

- Name: The THORName's string. Between 1-30 hexadecimal characters and

-_+special characters.; - Owner: This is the THORChain address that owns the THORName

- Aliases: THORNames can have an alias address for any external chain supported by THORChain, and can have an alias for the THORChain L1 that is different than the owner.

- Expiry: THORChain Block-height at which the THORName expires.

- Preferred Asset: The asset to pay out affiliate fees in. This can be any asset supported by THORChain.;

Create a THORName

THORNames are created by posting a MsgDeposit to the THORChain network with the appropriate memo and enough $RUNE to cover the registration fee and to pay for the amount of blocks the THORName should be registered for.;

- Registration fee:

tns_register_fee_runeon the Network endpoint. This value is in 1e8, so100000000 = 1 $RUNE - Per block fee:

tns_fee_per_block_runeon the same endpoint, also in 1e8.;

For example, for a new THORName to be registered for 10 years the amount paid would be:

amt = tns_register_fee_rune + tns_fee_per_block_rune * 10 * 5256000

5256000 = avg # of blocks per year

The expiration of the THORName will automatically be set to the number of blocks in the future that was paid for minus the registration fee.

Memo Format:

Memo template is: ~:name:chain:address:?owner:?preferredAsset:?expiry

- name: Your THORName. Must be unique, between 1-30 characters, hexadecimal and

-_+special characters.; - chain: The chain of the alias to set.;

- address: The alias address. Must be an address of chain.

- owner: THORChain address of owner (optional).

- preferredAsset: Asset to receive fees in. Must be supported be an active pool on THORChain. Value should be

assetproperty from the Pools endpoint.;

This will register a new THORName called ODIN with a Bitcoin alias of bc1Address owner of thorAddress and preferred asset of BTC.BTC.

You can use Asgardex to post a MsgDeposit with a custom memo. Load your wallet, then open your THORChain wallet page > Deposit > Custom.;

View your THORName's configuration at the THORName endpoint:

e.g. https://thornode.ninerealms.com/thorchain/thorname/{name}

Renewing your THORName

All THORName's have a expiration represented by a THORChain block-height. Once the expiration block-height has passed, another THORChain address can claim the THORName and any associated balance in the Affiliate Fee Collector Module (Read #preferred-asset-for-affiliate-fees), so it's important to monitor this and renew your THORName as needed.;

To keep your THORName registered you can extend the registration period (move back the expiration block height), by posting a MsgDeposit with the correct THORName memo and $RUNE amount.;

Memo:

~:ODIN:THOR:<thor-alias-address>

(Chain and alias address are required, so just use current values to keep alias unchanged).

$RUNE Amount:

rune_amt = num_blocks_to_extend * tns_fee_per_block

(Remember this value will be in 1e8, so adjust accordingly for your transaction).

Preferred Asset for Affiliate Fees

Starting in THORNode V116, affiliates can collect their fees in the asset of their choice (choosing from the assets that have a pool on THORChain). In order to collect fees in a preferred asset, affiliates must use a THORName in their swap memos.;

How it Works

If an affiliate's THORName has the proper preferred asset configuration set, the network will begin collecting their affiliate fees in $RUNE in the AffiliateCollector module. Once the accrued RUNE in the module is greater than PreferredAssetOutboundFeeMultiplier* outbound_fee of the preferred asset's chain, the network initiates a swap from $RUNE -> Preferred Asset on behalf of the affiliate. At the time of writing, PreferredAssetOutboundFeeMultiplier is set to 100, so the preferred asset swap happens when the outbound fee is 1% of the accrued $RUNE.;

Configuring a Preferred Asset for a THORName:

- Register your THORName following instructions above.

- Set your preferred asset's chain alias (the address you'll be paid out to), and your preferred asset. Note: your preferred asset must be currently supported by THORChain.

For example, if you wanted to be paid out in USDC you would:

-

Grab the full USDC name from the Pools endpoint:

ETH.USDC-0XA0B86991C6218B36C1D19D4A2E9EB0CE3606EB48 -

Post a

MsgDepositto the THORChain network with the appropriate memo to register your THORName, set your preferred asset as USDC, and set your Ethereum network address alias. Assuming the following info:- THORChain address:

thor1dl7un46w7l7f3ewrnrm6nq58nerjtp0dradjtd - THORName:

ac-test - ETH payout address:

0x6621d872f17109d6601c49edba526ebcfd332d5d;

The full memo would look like:

~:ac-test:ETH:0x6621d872f17109d6601c49edba526ebcfd332d5d:thor1dl7un46w7l7f3ewrnrm6nq58nerjtp0dradjtd:ETH.USDC-0XA0B86991C6218B36C1D19D4A2E9EB0CE3606EB48 - THORChain address:

You will also need a THOR alias set to collect affiliate fees. Use another MsgDeposit with memo: ~:<thorname>:THOR:<thorchain-address> to set your THOR alias. Your THOR alias address can be the same as your owner address, but won't be used for anything if a preferred asset is set.;

Once you successfully post your MsgDeposit you can verify that your THORName is configured properly. View your THORName info from THORNode at the following endpoint:

https://thornode.ninerealms.com/thorchain/thorname/ac-test

The response should look like:

{

"affiliate_collector_rune": "0",

"aliases": [

{

"address": "0x6621d872f17109d6601c49edba526ebcfd332d5d",

"chain": "ETH"

},

{

"address": "thor1dl7un46w7l7f3ewrnrm6nq58nerjtp0dradjtd",

"chain": "THOR"

}

],

"expire_block_height": 22061405,

"name": "ac-test",

"owner": "thor1dl7un46w7l7f3ewrnrm6nq58nerjtp0dradjtd",

"preferred_asset": "ETH.USDC-0XA0B86991C6218B36C1D19D4A2E9EB0CE3606EB48"

}

Your THORName is now properly configured and any affiliate fees will begin accruing in the AffiliateCollector module. You can verify that fees are being collected by checking the affiliate_collector_rune value of the above endpoint.

Tutorials

Find Savers Position

Endpoints have been made to look up a savers position quickly.

Savers Position using Thornode

Request: Get BTC saver information for the address 33XBYjiR3B7g8755mCB56aHtxQYL2Go9xf https://thornode.ninerealms.com/thorchain/pool/BTC.BTC/saver/33XBYjiR3B7g8755mCB56aHtxQYL2Go9xf

Response:

{

"asset": "BTC.BTC",

"asset_address": "33XBYjiR3B7g8755mCB56aHtxQYL2Go9xf",

"last_add_height": 8794877,

"units": "71338",

"asset_deposit_value": "71723",

"asset_redeem_value": "71830",

"growth_pct": "0.001491850591860352"

}

Returns all savers for a given asset. To get all savers you can use https://thornode.ninerealms.com/thorchain/pool/BTC.BTC/savers

Savers Position using Midgard

Request Get Savers Position for address 33XBYjiR3B7g8755mCB56aHtxQYL2Go9xf

https://midgard.ninerealms.com/v2/saver/33XBYjiR3B7g8755mCB56aHtxQYL2Go9xf

Response:

{

"pools": [

{

"assetAddress": "33XBYjiR3B7g8755mCB56aHtxQYL2Go9xf",

"assetBalance": "71723",

"assetWithdrawn": "0",

"dateFirstAdded": "1671838673",

"dateLastAdded": "1671838673",

"pool": "BTC.BTC",

"saverUnits": "71338"

}

]

}

Find Liquidity Position