Introduction

Overview

THORChain is a decentralised cross-chain liquidity protocol that allows users to add liquidity or swap over that liquidity. It does not peg or wrap assets. Swaps are processed as easily as making a single on-chain transaction.

THORChain works by observing transactions to its vaults across all the chains it supports. When the majority of nodes observe funds flowing into the system, they agree on the user's intent (usually expressed through a memo within a transaction) and take the appropriate action.

For more information see Understanding THORChain Technology or Concepts.

For wallets/interfaces to interact with THORChain, they need to:

- Connect to THORChain to obtain information from one or more endpoints.

- Construct transactions with the correct memos.

- Send the transactions to THORChain Inbound Vaults.

See this THORChain Development Guide video for more information or check out the Front-end guides below for fast and simple implementation.

Front-end Development Guides

Native Swaps Guide

Frontend developers can use THORChain to access decentralised layer1 swaps between BTC, ETH, ATOM and more.

Affiliate Guide

THORChain offers user interfaces affiliate fees up to 10% for using THORChain.

Aggregators

Aggregators can deploy contracts that use custom swapIn and swapOut cross-chain aggregation to perform swaps before and after THORChain.

Eg, swap from an asset on Sushiswap, then THORChain, then an asset on TraderJoe in one transaction.

Concepts

In-depth guides to understand THORChain's implementation have been created.

Libraries

Several libraries exist to allow for rapid integration. xchainjs has seen the most development is recommended.

Eg, swap from layer 1 ETH to BTC and back.

Analytics

Analysts can build on Midgard or Flipside to access cross-chain metrics and analytics. See Connecting to THORChain for more information.

Connecting to THORChain

THORChain has several APIs with Swagger documentation.

- Midgard - https://midgard.ninerealms.com/v2/doc

- THORNode - https://thornode.ninerealms.com/thorchain/doc

- Cosmos RPC - https://docs.cosmos.network/v0.50/learn/advanced/grpc_rest

- CometBFT RPC - https://docs.cometbft.com/v0.38/rpc/

A list of endpoints operated by Nine Realms is located at NineRealms THORChain Ops Dashboard.

See Connecting to THORChain for more information.

Support and Questions

Join the THORChain Dev Discord for any questions or assistance.

THORChain (RUNE) Technical Custody & Network FAQs - Technical Integration

Differentiating Features and Protocol Customizations

THORChain is built on the Cosmos SDK, with several alterations and customizations tailored to its use case.

-

Custom Handlers:

- Add liquidity, withdraw liquidity, and swap handlers: Facilitate cross-chain liquidity pooling and swaps.

- Reserve module: Manages a Reserve of 78.8M RUNE, used for block rewards.

- RUNEPool module: Phased in to allow RUNE liquidity provision across pools. See the Dashboard for more information.

-

Bifrost & Threshold Signatures:

- THORChain uses Bifrost to facilitate native, L1 cross-chain swaps. It runs a fullnode RPC daemon for each network it connects to and utilizes Threshold Signature Scheme (TSS) technology for multi-encryption management of assets across blockchains.

-

Custom Governance Mechanisms:

- THORChain’s governance is distinct from the Cosmos SDK’s generic module. RUNE holders are not voting members; node operators receive votes. Most economic parameters require a 2/3 majority to change, while some operational parameters require 3 votes, which can be overridden by 4 votes.

Token Transfers, Staking, and Rewards

Token Transfer Mechanisms

RUNE tokens can be transferred via:

- Signed transactions (e.g.,

MsgSend). - Reserve to liquidity pools and nodes (block rewards).

- Reserve to liquidity pools or vice versa (protocol-owned liquidity).

- RUNE holders to/from the reserve (buying and selling shares of POL).

- Minted/burned from the Reserve (lending).

Reward Claiming

- Reserve and RUNEPool: For liquidity provision and protocol-owned liquidity transactions.

Transaction Protocol Modifications

Transaction Construction

- Method: Follows standard Cosmos SDK transaction construction and broadcasting.

- Example:

{

"body": {

"messages": [

{

"@type": "/types.MsgSend",

"from_address": "thor1htrqlgcqc8lexctrx7c2kppq4vnphkatgaj932",

"to_address": "thor1qvlul0ujfrq27ja7uxrp8r7my9juegz0ug3nsg",

"amount": [

{

"denom": "rune",

"amount": "649600000000"

}

]

}

],

"memo": "",

"timeout_height": "0",

"extension_options": [],

"non_critical_extension_options": []

},

"auth_info": {

"signer_infos": [],

"fee": {

"amount": [],

"gas_limit": "200000",

"payer": "",

"granter": ""

}

},

"signatures": []

}

Execution Time

- Approximately 6 seconds (default block time).

Cryptographic Algorithms

- Signing: secp256k1 (same as Cosmos); TSS vaults support both ECDSA (secp256k1) and EDDSA (ed25519).

Serialization Protocol

- Transactions: Protobuf and JSON.

Hashing Algorithm

- Transactions: sha256.

Address Creation

- Addresses: Derived using the bech32 specification.

Replay Prevention

- Mechanism: Transactions are signed with a Sequence to prevent replay attacks.

Unique Transaction Fields

- Memo: Arbitrary string (256 characters max for THORChain, other chains have different memo lengths).

- Timeout height: Expire transactions at a future block height.

Libraries and Gas

- Libraries: Go libraries available for signing Cosmos-style transactions.

- Gas: Charged in RUNE, fixed rate currently; excess gas not refunded.

Account Creation and Privacy

- Accounts: Implicitly derived from private keys; do not exist until tokens are received.

- Privacy: No privacy features.

Balance Changes and Transaction Queries

- Balance Changes: Can occur via store migrations.

- Transaction Queries:

- For deposits: Use

https://thornode.ninerealms.com/thorchain/blockand Midgard API. - For transaction status: Use standard endpoints or examples provided.

- For deposits: Use

Storage and Throughput

- Storage Growth: Approximately 90G pruned state; historical growth of 500G every 90 days.

- Throughput: Monolithic chain; state growth linear to # of validators and chains.

Full Node and Smart Contracts

- Local Mode: Available through mocknet environment.

- Smart Contracts: No current smart contracts; CosmWasm integration planned but not necessary for RUNE transfers.

Staking

Does this blockchain support staking?

THORChain does not have traditional “staking”. The only way RUNE can be used in the network is to provide liquidity (dual-sided LP or RUNEPool) or to secure TSS vaults and verify transactions, which node operators must secure with a bond and be subject to slashing. Henceforth, references to “staking” are answered with respect to “bonding”.

What asset is used for staking?

RUNE. A minimum of 300,000 RUNE, sent by the network variable MinimumBondInRune, is required to become a validator. Due to rewards being set by an algorithm that favors higher bonds. See the THORNode dashboard for current bond details - generally the average bond amount is required to become and stay active.

Can accounts delegate their tokens to be staked by a different validator?

Accounts must choose which validator to stake to, and a node operator can only whitelist “bond providers”. Currently there is a max of 10 bond providers per node, set my the network mimir setting MAXBONDPROVIDERS, however there is a campaign underway to increase this number to 100. This is different from most “distributed proof-of-stake” networks. It requires bonders to have a relationship with their bond providers, curtailing “public, branded validators”. Validators are anonymous entities and may conduct their own business development to find bond providers. Bond providers themselves have no stake in governance. There is a proposed feature for AutoBond, which will allow users to provide bond that is split evenly across validators without explicit bi-directional coordination. See Pooled THORNodes for more information.

How soon after calling the staking operation can a staker start accruing rewards?

After the validator churns in, rewards begin accruing based on system income from swap fees and block rewards. Validators churn their vaults every 3 days, proving liveness of funds and giving an opportunity for new validators to participate. Every churn, the lowest bond, highest slash, and oldest node churn out. Once a validator has churned out, bond providers can withdraw their principal + pro-rata share of rewards.

What are the slashing conditions and penalties?

Bond principal is slashed by more than the outbound amount if the rest of the network observes funds being sent out of a vault without a corresponding ledger entry (double spend or theft). Loss of principal is the primary driver of economic security. Validators must bond more than they secure, and stand to lose more than they gain from theft or bad behavior. Rewards are slashed for missed observations on L1 chains or missing/double signing a block.

How long is the unbonding period?

Bond is available for withdrawal after a validator churns out.

Do the tokens leave the custody of the delegator when this happens?

Yes, they are held in the network’s bond module. Bonders giving up custody of their RUNE is the basis of economic security.

Are staking rewards claimed on-chain, automatically or in response to a claim transaction, or must the validator send rewards back manually?

Rewards are accrued to a bond provider’s amount, which is a separate ledger. They must be withdrawn by an explicit UNBOND transaction and can only be withdrawn when a validator is churned out. Otherwise, they continue to accrue in the absence of explicit UNBOND transactions.

Are staking rewards automatically redelegated as they accumulate or must they be claimed and redelegated with a transaction?

Yes, see above.

How much staking rewards are distributed as a percentage of total issuance?

It depends on the Incentive Pendulum. When network security is optimal (2 RUNE for every 1 RUNE of non-RUNE pooled assets, e.g., $50m RUNE bonded and $25m L1 pooled), the network security is considered optimal, and block rewards are split 33%/67% in favor of liquidity providers. When network security approaches 1:1 (danger of becoming underbonded), block rewards shift 100% to node operators to incentivize more bonded RUNE.

Governance

Does this blockchain support governance?

Yes.

How are votes conducted?

Votes are conducted by transactions signed on-chain by validators.

What protocol parameters can be changed through governance?

Nodes can vote to change specific parameters, as enumerated here:

See the Constants and Mimir page for details. At any given time, multiple votes are underway, and node operators often change their votes for a given constant as a response to changes in market conditions and desired performance. For example, at this time, a faction of nodes is campaigning to increase minimum L1 swap fees from 5bps to 15bps. The current vote is at 54.17% in favor of 15bps, and the swap fee will remain 5bps until the 15bps vote reaches 67%+.

What is the mechanism by which change is enacted? A dedicated smart contract, a node client upgrade, etc.

Nodes can campaign to change an existing parameter by simply starting a vote on-chain and relaying their rationale in a message signed by their validator address. Developers, nodes, and community members can propose changes to existing parameters OR creation of new parameters by following the Architecture Design Record (ADR) process, documented here: ADR Documentation

How are the measures to vote on published?

There is generally an announcement in Discord, often linked to an ADR (Architecture Design Review) which is detailed in a markdown file committed to the THORNode repository with corresponding discussion channels in Discord. Less controversial or complex changes may have only a description in Discord or a Gitlab issue.

Does this blockchain support other kinds of participation that institutional investors would be interested in? Please describe it.

RUNEPool allows RUNE holders to participate in POL, though this is a complex financial product subject to impermanent loss. “Auto Bond” has been proposed but not yet voted on or implemented. It would make THORChain more similar to a distributed proof-of-stake network but allow any holder to add RUNE to the share of total RUNE bonded validators.

Do you have any vesting schedules? If so:

Is the vesting on-chain / off (paper)-chain? Please describe.

There are no formal staking agreements in place between the network and any of its participants. RUNE is fully distributed. Teams or holders of RUNE may have their own staking agreements with their own third parties. 5bps of system income will soon be paid to a developer fund to incentivize THORChain’s ongoing development. This fund is currently controlled by Nine Realms, a U.S.-based technology services firm, which maintains the THORChain software development life cycle on behalf of nodes. Nodes have the final say of anything that happens on the network. Nodes may campaign to change the beneficiary of the developer fund at any time if they feel their needs are not being met.

Quickstart Guide

Introduction

THORChain allows native L1 Swaps. On-chain Memos are used instruct THORChain how to swap, with the option to add price limits and affiliate fees. THORChain nodes observe the inbound transactions and when the majority have observed the transactions, the transaction is processed by threshold-signature transactions from THORChain vaults.

Let's demonstrate decentralised, non-custodial cross-chain swaps. In this example, we will build a transaction that instructs THORChain to swap native Bitcoin to native Ethereum in one transaction.

For chains with limited memo space (like Bitcoin's 80-byte OP_RETURN), see the Memoless Swaps Guide for reference memo registration and amount encoding.

The following examples use a free, hosted API provided by Nine Realms. If you want to run your own full node, please see connecting-to-thorchain.md.

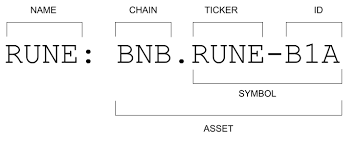

1. Determine the correct asset name

THORChain uses a specific asset notation. Available assets are at: Pools Endpoint.

BTC => BTC.BTC

ETH => ETH.ETH

2. Query for a swap quote

All amounts are 1e8. Multiply native asset amounts by 100000000 when dealing with amounts in THORChain. 1 BTC = 100,000,000.

Request: Swap 1 BTC to ETH and send the ETH to 0x86d526d6624AbC0178cF7296cD538Ecc080A95F1 using Streaming Swaps, swapping every block (streaming_interval=1) and allowing THORNode to work out the optimal amount of blocks (streaming_quantity=0).

Response:

{

"inbound_address": "bc1qt9723ak9t7lu7a97lt9kelq4gnrlmyvk4yhzwr",

"inbound_confirmation_blocks": 1,

"inbound_confirmation_seconds": 600,

"outbound_delay_blocks": 179,

"outbound_delay_seconds": 1074,

"fees": {

"asset": "ETH.ETH",

"affiliate": "0",

"outbound": "54840",

"liquidity": "2037232",

"total": "2092072",

"slippage_bps": 9,

"total_bps": 10

},

"slippage_bps": 41,

"streaming_slippage_bps": 9,

"expiry": 1722575316,

"warning": "Do not cache this response. Do not send funds after the expiry.",

"notes": "First output should be to inbound_address, second output should be change back to self, third output should be OP_RETURN, limited to 80 bytes. Do not send below the dust threshold. Do not use exotic spend scripts, locks or address formats (P2WSH with Bech32 address format preferred).",

"dust_threshold": "10000",

"recommended_min_amount_in": "10760",

"recommended_gas_rate": "4",

"gas_rate_units": "satsperbyte",

"memo": "=:ETH.ETH:0x86d526d6624AbC0178cF7296cD538Ecc080A95F1:0/1/0",

"expected_amount_out": "2035299208",

"expected_amount_out_streaming": "2035299208",

"max_streaming_quantity": 8,

"streaming_swap_blocks": 7,

"streaming_swap_seconds": 42,

"total_swap_seconds": 1674

If you send 1 BTC to bc1qt9723ak9t7lu7a97lt9kelq4gnrlmyvk4yhzwr with the memo =:ETH.ETH:0x86d526d6624AbC0178cF7296cD538Ecc080A95F1:0/1/0, you can expect to receive 20.35299208 ETH.

For security reasons, your inbound transaction will be delayed by 600 seconds (1 BTC Block) and 1074 seconds (or 179 native THORChain blocks) for the outbound transaction, 2640 seconds all up*. You will pay an outbound gas fee of 0.0054 ETH and will incur 9 basis points (0.09%) of slippage due to streaming swaps, would be 41 bps without StreamingSwaps.* The swap will be conduced over 7 blocks taking 42 seconds for the streaming swap to complete.

Full quote swap endpoint specification can be found here: https://thornode.ninerealms.com/thorchain/doc/.

If you'd prefer to calculate the swap yourself, see the Fees section to understand what fees need to be accounted for in the output amount. Also, review the Transaction Memos section to understand how to create the swap memos.

3. Sign and send transactions on the from_asset chain

Construct, sign and broadcast a transaction on the BTC network with the following parameters:

- Amount =>

1.0 - Recipient =>

bc1qt9723ak9t7lu7a97lt9kelq4gnrlmyvk4yhzwr - Memo =>

=:ETH.ETH:0x86d526d6624AbC0178cF7296cD538Ecc080A95F1:0/1/0

Never cache inbound addresses! Quotes should only be considered valid for 10 minutes. Sending funds to an old inbound address will result in loss of funds.

Learn more about how to construct inbound transactions for each chain type here: Sending Transactions

4. Receive tokens

Once a majority of nodes have observed your inbound BTC transaction, they will sign the Ethereum funds out of the network and send them to the address specified in your transaction. You have just completed a non-custodial, cross-chain swap by simply sending a native L1 transaction.

Additional Considerations

There is a rate limit of 1 request per second per IP address on /quote endpoints. It is advised to put a timeout on frontend components input fields, so that a request for quote only fires at most once per second. If not implemented correctly, you will receive 503 errors.

For best results, request a new quote right before the user submits a transaction. This will tell you whether the expected_amount_out has changed or if the inbound_address has changed. Ensuring that the expected_amount_out is still valid will lead to better user experience and less frequent failed transactions.

Price Limits

Specify liquidity_tolerance_bps to give users control over the maximum slip they are willing to experience before canceling the trade. If not specified, users can pay an unbounded amount of slip. The limit is calculated based on the value of expected_amount_out.

https://thornode.ninerealms.com/thorchain/quote/swap?amount=100000000&from_asset=BTC.BTC&to_asset=ETH.ETH&destination=0x3021c479f7f8c9f1d5c7d8523ba5e22c0bcb5430&liquidity_tolerance_bps=500

Notice how a minimum amount (1342846539 / ~13.42 ETH) has been appended to the end of the memo. This tells THORChain to revert the transaction if the transacted amount is more than 500 basis points less than what the expected_amount_out returns.

Note that the parameter tolerance_bps can be used instead, but this field does not take swap or outbound fees into account when calculating the limit, which will result in more failed swaps. Instead, it calculates the price limit solely based on the value of the input asset.

Affiliate Fees

Specify affiliate and affiliate_bps to skim a percentage of the swap as an affiliate fee. When a valid affiliate address and affiliate basis points are present in the memo, the protocol will skim affiliate_bps from the inbound swap amount and swap this to $RUNE with the affiliate address as the destination address. Affiliates may either be a RUNE address or a registered & un-expired THORName with a THORChain alias defined. If the THORName has a preferred asset set it must also have an alias for the preferred asset's chain. If an invalid, improperly configured, or expired THORName, or an invalid RUNE address is provided as an affiliate, the affiliate fee will be skipped.

Params:

- affiliate: Can be a THORName or valid THORChain address

- affiliate_bps: 0-1000 basis points

Memo format:

=:BTC.BTC:<destination_addr>:<limit>:<affiliate>:<affiliate_bps>

Quote example:

{

"inbound_address": "bc1qt9723ak9t7lu7a97lt9kelq4gnrlmyvk4yhzwr",

"inbound_confirmation_blocks": 1,

"inbound_confirmation_seconds": 600,

"outbound_delay_blocks": 177,

"outbound_delay_seconds": 1062,

"fees": {

"asset": "ETH.ETH",

"affiliate": "2036420",

"outbound": "54840",

"liquidity": "8303006",

"total": "10394266",

"slippage_bps": 40,

"total_bps": 51

},

"slippage_bps": 40,

"streaming_slippage_bps": 40,

"expiry": 1722575770,

"warning": "Do not cache this response. Do not send funds after the expiry.",

"notes": "First output should be to inbound_address, second output should be change back to self, third output should be OP_RETURN, limited to 80 bytes. Do not send below the dust threshold. Do not use exotic spend scripts, locks or address formats (P2WSH with Bech32 address format preferred).",

"dust_threshold": "10000",

"recommended_min_amount_in": "242563",

"recommended_gas_rate": "4",

"gas_rate_units": "satsperbyte",

"memo": "=:ETH.ETH:0x3021c479f7f8c9f1d5c7d8523ba5e22c0bcb5430::dx:10",

"expected_amount_out": "2017703535",

"expected_amount_out_streaming": "",

"max_streaming_quantity": 0,

"streaming_swap_blocks": 0,

"total_swap_seconds": 1662

}

Notice how dx:10 has been appended to the end of the memo. This instructs THORChain to skim 10 basis points from the swap. The user should still expect to receive the expected_amount_out, meaning the affiliate fee has already been subtracted from this number.

For more information on affiliate fees: Affiliate Fee Guide.

Multiple Affiliates

Interfaces can define up to 5 valid affiliate and affiliate basis points pairs in a swap memo and the network will attempt to skim an affiliate fee for each. Alternatively, up to 5 valid affiliates and exactly one valid basis points can be defined, and the network will attempt to skim the same basis points fee for each affiliate.

Note: When using the /quote/swap endpoint with multiple affiliates, the order of affiliate and affiliate_bps fields in the query string does not determine their order in the final memo. The API will automatically sort affiliate names alphabetically when constructing the memo.

This means:

- The affiliate names in the memo will appear in alphabetical order.

- The corresponding

bpsvalues are still correctly aligned with their respectiveaffiliatevalues from the query.

⚠️ If your interface logic assumes that the memo preserves the order of affiliates as supplied in the query, you must account for this sorting behavior to avoid mismatches.

Valid memo examples:

=:ETH.ETH:0x3021c479f7f8c9f1d5c7d8523ba5e22c0bcb5430::t1/t2/t3/t4/t5:10(Will skim 10 basis points for each of the affiliates)=:ETH.ETH:0x3021c479f7f8c9f1d5c7d8523ba5e22c0bcb5430::t1/thor1t2hav42urasnsvwa6x6fyezaex9f953plh72pq/t3:10/20/30(Will skim 10 basis points fort1, 20 basis points forthor1t2hav42urasnsvwa6x6fyezaex9f953plh72pq, and 30 basis points fort3)

Invalid memo examples:

=:ETH.ETH:0x3021c479f7f8c9f1d5c7d8523ba5e22c0bcb5430::t1/t2/t3/t4/t5:10/20(5 affiliates defined, but only 2 affiliate basis points)=:ETH.ETH:0x3021c479f7f8c9f1d5c7d8523ba5e22c0bcb5430::t1/t2/t3/t4/t5/t6:10(Too many affiliates defined)

Streaming Swaps

Streaming Swaps is the recommended default which breaks up the trade to reduce slip fees.

Params:

- streaming_interval: # of THORChain blocks between each subswap. Larger # of blocks gives arb bots more time to rebalance pools. For deeper/more active pools a value of

1is most likely okay. For shallower/less active pools a larger value should be considered. - streaming_quantity: # of subswaps to execute. If this value is omitted or set to

0the protocol will calculate the # of subswaps such that each subswap has a slippage of 5 bps.

Memo format:

=:BTC.BTC:<destination_addr>:<limit>/<streaming_interval>/<streaming_quantity>

Quote example:

{

"inbound_address": "bc1qjqrzsszkr6g0autrveuv7vjryytk0pkqdwhuz2",

"inbound_confirmation_blocks": 1,

"inbound_confirmation_seconds": 600,

"outbound_delay_blocks": 720,

"outbound_delay_seconds": 4320,

"fees": {

"asset": "ETH.ETH",

"affiliate": "0",

"outbound": "285660",

"liquidity": "3228480",

"total": "3514140",

"slippage_bps": 21,

"total_bps": 22

},

"expiry": 1722575809,

"warning": "Do not cache this response. Do not send funds after the expiry.",

"notes": "First output should be to inbound_address, second output should be change back to self, third output should be OP_RETURN, limited to 80 bytes. Do not send below the dust threshold. Do not use exotic spend scripts, locks or address formats (P2WSH with Bech32 address format preferred).",

"dust_threshold": "10000",

"recommended_min_amount_in": "74260",

"recommended_gas_rate": "4",

"gas_rate_units": "satsperbyte",

"memo": "=:ETH.ETH:0x3021c479f7f8c9f1d5c7d8523ba5e22c0bcb5430:0/10/0",

"expected_amount_out": "1531908900",

"max_streaming_quantity": 1440,

"streaming_swap_blocks": 14390,

"streaming_swap_seconds": 86340,

"total_swap_seconds": 86940

}

Notice how slippage_bps shows the savings by using streaming swaps. streaming_swap_seconds also shows the amount of time the swap will take.

Custom Refund Address

By default, in the case of a refund the protocol will return the inbound swap to the original sender. However, in the case of protocol <> protocol interactions, many times the original sender is a smart contract, and not the user's EOA. In these cases, a custom refund address can be defined in the memo, which will ensure the user will receive the refund and not the smart contract.

Params:

- refund_address: User's refund address. Needs to be a valid address for the inbound asset, otherwise refunds will be returned to the sender

Memo format:

=:BTC.BTC:<destination>/<refund_address>

{

...

"memo": "=:BTC.BTC:bc1qyl7wjm2ldfezgnjk2c78adqlk7dvtm8sd7gn0q/0x3021c479f7f8c9f1d5c7d8523ba5e22c0bcb5430",

...

}

Error Handling

The quote swap endpoint simulates all of the logic of an actual swap transaction and includes comprehensive error handling. Below are specific examples of errors that can occur:

Price Tolerance Error

Description: This error means the swap cannot be completed given your price tolerance. This error can usually be avoided by using the preferred slippage parameter liquidity_tolerance_bps. Click here to view request URL.

Request URL:

https://thornode.ninerealms.com/thorchain/quote/swap \

from_asset=BTC.BTC \

to_asset=ETH.ETH \

amount=100000000 \

destination=0x86d526d6624AbC0178cF7296cD538Ecc080A95F1 \

streaming_interval=1 \

streaming_quantity=0 \

tolerance_bps=1

Response:

{"code":3,"message":"failed to simulate swap: failed to simulate handler: emit asset 2651686248 less than price limit 2719908600: invalid request","details":[]}

Destination Address Error

Description: This error ensures the destination address is for the chain specified by to_asset. Click here to view request URL.

Request URL:

https://thornode.ninerealms.com/thorchain/quote/swap \

from_asset=BTC.BTC \

to_asset=ETH.ETH \

amount=100000000 \

destination=bc1qyl7wjm2ldfezgnjk2c78adqlk7dvtm8sd7gn0q \

streaming_interval=1

Response:

{"code":2,"message":"failed to simulate swap: failed to validate message: swap destination address is not the same chain as the target asset: unknown request [cosmossdk.io/errors@v1.0.2/errors.go:151]: unknown request","details":[]}

Affiliate Address Length Error

Description: This error is due to the fact the affiliate address is too long given the source chain's memo length requirements. Try registering a THORName to shorten the memo. Click here to view request URL.

Request URL:

https://thornode.ninerealms.com/thorchain/quote/swap \

from_asset=BTC.BTC \

to_asset=ETH.ETH \

amount=100000000 \

destination=0x86d526d6624AbC0178cF7296cD538Ecc080A95F1 \

streaming_interval=1 \

liquidity_tolerance_bps=100 \

affiliate=thor1rr6rahhd4sy76a7rdxkjaen2q4k4pw2g06w7qp \

affiliate_bps=10

Response:

{"code":3,"message":"generated memo too long for source chain: invalid request","details":[]}

Asset Not Found Error

This error means the requested asset does not exist. Click here to view request URL.

Request URL:

https://thornode.ninerealms.com/thorchain/quote/swap \

from_asset=BTC.BTC \

to_asset=<20bf> \

amount=100000000 \

destination=0x86d526d6624AbC0178cF7296cD538Ecc080A95F1 \

streaming_interval=1 \

liquidity_tolerance_bps=100 \

affiliate=thor1rr6rahhd4sy76a7rdxkjaen2q4k4pw2g06w7qp \

affiliate_bps=10

Response:

{"code":3,"message":"bad to asset: invalid symbol: invalid request","details":[]}

Bound Checks Error

Bound checks are made on both affiliate_bps and liquidity_tolerance_bps. Click here to view request URL.

Request URL:

https://thornode.ninerealms.com/thorchain/quote/swap \

from_asset=BTC.BTC \

to_asset=ETH.ETH \

amount=100000000 \

destination=0x86d526d6624AbC0178cF7296cD538Ecc080A95F1 \

streaming_interval=1 \

liquidity_tolerance_bps=10015 \

affiliate=dx \

affiliate_bps=1

Response:

{"code":3,"message":"liquidity tolerance basis points must be less than 10000: invalid request","details":[]}

Minimum Swap Amount Error

Description: This error occurs when the swap amount is less than the minimum required amount to cover fees. The error message now includes the recommended minimum amount. Click here to view request URL.

Request URL:

https://thornode.ninerealms.com/thornode/quote/swap \

from_asset=ETH.ETH \

to_asset=BTC.BTC \

amount=1000 \

destination=bc1qyl7wjm2ldfezgnjk2c78adqlk7dvtm8sd7gn0q \

streaming_interval=1

Response:

{"code":3,"message":"amount less than min swap amount (recommended_min_amount_in: 17895): invalid request","details":[]}

Below Dust Threshold Error

Description: This error occurs when the swap amount is less than the dust threshold of the inbound chain. THORChain will not observe inbound transactions less than the dust threshold. Refer to the dust threshold section for more information. Click here to view request URL

Request URL:

https://thornode.ninerealms.com/thornode/quote/swap \

from_asset=BTC.BTC \

to_asset=ETH.ETH \

amount=100 \

destination=0x86d526d6624AbC0178cF7296cD538Ecc080A95F1 \

streaming_interval=1

Response:

{"code":3,"message":"amount less than dust threshold: invalid request","details":[]}

Support

Developers experiencing issues with these APIs can go to the THORChain Dev Discord for assistance. Interface developers should subscribe to the #interface-alerts channel for information pertinent to the endpoints and functionality discussed here.

Memoless Swaps (Bitcoin and Limited Memo Chains)

For chains with limited memo space (like Bitcoin's 80-byte OP_RETURN), THORChain supports memoless transactions using reference memos. This guide provides a quick start for implementing memoless swaps.

For complete technical details on memoless transactions, see Memos - Reference Memo.

Overview

Memoless swaps allow you to:

- Register a swap memo once, use multiple times

- Encode reference numbers in transaction amounts

- Avoid memo length restrictions on UTXO and other memo-limited chains

Memoless Swap Checklist

Phase 1: Register Reference Memo

-

Send Registration Transaction: Send RUNE to inbound address with memo:

REFERENCE:BTC.BTC:=:ETH.ETH:0x86d526d6624AbC0178cF7296cD538Ecc080A95F1See REFERENCE memo format for details.

-

Wait for Confirmation: Monitor the registration transaction hash

-

Get Reference Number: Call

GET /thorchain/memo/{registration_hash}once block is final{ "reference": "20002", "asset": "BTC.BTC", "memo": "=:ETH.ETH:0x86d526d6624AbC0178cF7296cD538Ecc080A95F1", "height": "12345678" }

Phase 2: Execute Memoless Swap

-

Validate Reference: Call

GET /thorchain/memo/BTC.BTC/20002before broadcasting- Ensure response is valid and not expired

- Check usage count within limits

- Verify reference lifecycle state

-

Encode Amount:

Desired amount: 0.05 BTC = 5,000,000 sats Reference: 20002 Final amount: 5,020,002 satsSee Encoding Algorithm for detailed steps.

-

Send Bitcoin Transaction:

- Amount: 5,020,002 sats

- To: BTC inbound address from

/thorchain/inbound_addresses - Memo: Empty (reference encoded in amount) or

R:20002(explicit reference)

See Sending Transactions - UTXO Chains for transaction structure.

-

Monitor Results: Reference will be marked as used and require re-registration for future swaps

Check usage via

GET /thorchain/memo/BTC.BTC/20002

Memoless Error Conditions

| Condition | Resolution |

|---|---|

| Reference Not Found | Re-register or check reference number |

| Reference Expired | Re-register with new reference (TTL expired) |

| Usage Limit Exceeded | Re-register for additional uses |

| Same Block Usage | Wait for next block after registration |

| Memoless Halted | Check HaltMemoless mimir status |

Memoless Transaction Errors

Reference Not Found Error

{ "error": "reference memo not found for asset BTC.BTC reference 20002" }

Resolution: Re-register the reference memo or verify reference number

Reference Expired Error

{ "error": "reference memo expired for asset BTC.BTC reference 20002" }

Resolution: Register a new reference memo with same parameters. References expire after MemolessTxnTTL blocks (default: 3600 blocks ≈ 6 hours).

Usage Limit Exceeded Error

{ "error": "reference memo usage limit exceeded for reference 20002" }

Resolution: Register a new reference memo for additional uses. Default limit is MemolessTxnMaxUse = 1 use per reference.

Same Height Usage Error

{ "error": "transaction observed before reference memo creation" }

Resolution: Wait for next block after registration before using reference. Transactions must be observed after the reference registration height.

Memoless Halted Error

{ "error": "memoless transactions are currently halted" }

Resolution: Check THORChain status - emergency halt is active. Monitor HaltMemoless mimir and wait for unhalt before attempting memoless transactions.

Pre-Flight Validation API

Always validate before broadcasting:

# Check if reference exists and is valid

GET /thorchain/memo/{asset}/{reference}

# Preview reference extraction from amount

GET /thorchain/memo/check/{asset}/{amount}

Reference memos expire after ~6 hours (MemolessTxnTTL). If your inbound transaction remains unconfirmed beyond the TTL, THORChain can no longer resolve the reference and the swap will not execute. You are responsible for ensuring confirmation before expiry.

fees and confirmation times appropriately.

Best practice

- Use RBF/fee-bump to accelerate confirmation if mempool congestion increases.

- If confirmation before TTL looks unlikely, RBF-cancel (double-spend to self) and re-register a fresh reference, then resend.

- Don’t broadcast close to expiry; choose a feerate that targets confirmation well within the TTL (with buffer).

Transactions that arrive after TTL may be unrecoverable without manual intervention. Proceed only if you can manage fees and confirmation times appropriately.

See API Endpoints for full documentation.

Related Documentation

- Memos - Reference Memo Technical Details

- Reference Memo Lifecycle States

- Amount Encoding Algorithm

- Sending Transactions - UTXO Chains

- Memoless Transaction Mimirs

- Network Halts - Memoless

Advanced Swap Queue

Overview

The Advanced Swap Queue is THORChain's enhanced swap processing system that provides improved performance, better price discovery, and support for limit swaps. It represents a significant upgrade from the legacy swap queue, offering multiple swap types and advanced processing capabilities.

Key Features

Swap Types

The advanced queue supports three distinct swap types:

1. Market Swaps (= prefix)

- Immediate Execution: Attempt to execute as soon as possible at current market prices

- Price Protection: Can include trade limits - swap is refunded if minimum output not achievable

- No Queue Persistence: Execute immediately or refund, don't wait in queue

- Example:

=:BTC.BTC:bc1qaddress:50000000(with minimum output protection)

2. Limit Swaps (=< prefix)

- Conditional Execution: Only execute when price conditions are met

- Queue Persistence: Remain in queue until executed or expired

- Price Waiting: Will wait for favorable conditions rather than immediate refund

- Example:

=<:ETH.ETH:0xaddress:2000000000/0/0

3. Rapid Swaps

- Multiple Iterations: Process multiple swaps per block for improved throughput

- Configurable: Controlled by

AdvSwapQueueRapidSwapMaxmimir setting - Performance Optimization: Reduces queue congestion during high activity

Queue Modes

The advanced swap queue operates in different modes controlled by the EnableAdvSwapQueue mimir setting:

| Mode | Value | Description |

|---|---|---|

| Disabled | 0 | Uses legacy swap queue system |

| Enabled | 1 | Full advanced queue with market and limit swaps |

| Market-only | 2 | Advanced queue for market swaps only, limit swaps are skipped |

Behavioral Differences

Default Streaming Behavior

IMPORTANT CHANGE: The advanced swap queue changes the default swap behavior:

- Legacy Queue: Simple swaps by default (no streaming)

- Advanced Queue: Streaming swaps by default when no interval/quantity specified

When you omit interval and quantity parameters (e.g., =:ETH.ETH:0xaddress), the advanced queue will:

- Calculate optimal streaming parameters based on swap size and pool conditions

- Execute as streaming swap with rapid processing (interval = 0)

- Maximize price efficiency through multiple sub-swaps

To disable streaming: Explicitly set /1/1 (1 sub-swap every 1 block)

Examples:

# Advanced queue default behavior (auto-streaming)

=:ETH.ETH:0xaddress:250000000

# Force single swap (disable streaming)

=:ETH.ETH:0xaddress:250000000/1/1

# Legacy behavior (when advanced queue disabled)

SWAP:ETH.ETH:0xaddress:250000000 # Single swap

Processing Order

The advanced queue processes swaps using a rapid iteration framework with two phases per iteration:

- Market Swaps Phase: All market swaps are fetched and processed for immediate execution

- Limit Swaps Phase: Limit swaps are evaluated per trading pair for conditional execution

Rapid Processing Framework: The entire two-phase process can be repeated multiple times per block (controlled by AdvSwapQueueRapidSwapMax setting), enabling higher throughput when there are swaps ready to execute.

Key Behavioral Differences

Market Swaps vs Limit Swaps

| Aspect | Market Swaps (=) | Limit Swaps (=<) |

|---|---|---|

| Execution | Immediate attempt | Wait for conditions |

| Price Protection | Refund if target not met | Wait until target achievable |

| Queue Behavior | Execute or refund immediately | Persist until executed/expired |

| Use Case | "Swap now at this price or better" | "Swap when price reaches target" |

Price Discovery

The advanced queue uses sophisticated price discovery mechanisms:

Fee-less Swap Validation

- Initial price check without considering fees

- Determines if a limit swap can potentially execute

- More efficient than full swap simulation

Fee-inclusive Validation

- Secondary check including all fees (swap fees, outbound fees)

- Ensures profitable execution after all costs

- Prevents failed transactions

Ratio-based Indexing

- Limit swaps are indexed by their target price ratios

- Enables efficient discovery of executable swaps

- Sorted processing from most favorable to least favorable ratios

Streaming Integration

Advanced queue seamlessly integrates with streaming swaps with enhanced interval behavior:

Interval Behavior Changes

The advanced queue introduces important changes to how streaming intervals work:

Interval = 0 (Rapid Streaming):

- Multiple sub-swaps per block: Can execute several streaming sub-swaps in a single block

- Rapid execution: Maximizes throughput when

AdvSwapQueueRapidSwapMax> 1 - Use case: Fast completion of streaming swaps when conditions are favorable

Interval ≥ 1 (Traditional Streaming):

- One sub-swap per interval: Executes exactly one streaming sub-swap every X blocks

- Block spacing: Waits for the specified interval between executions

- Use case: Time-distributed execution for better price averaging

Streaming Types

- Streaming Market Swaps: Execute over multiple blocks with configurable intervals

- Streaming Limit Swaps: Combine price conditions with streaming execution

- Optimized Scheduling: Intelligent scheduling based on pool conditions and interval settings

Boundaries and Limits

Time-to-Live (TTL) Management

Default TTL: 43,200 blocks (~3 days)

=<:BTC.BTC:bc1qaddress:50000000 # Uses default 43,200 block TTL

Custom TTL: Specify via interval parameter (max 43,200 blocks)

=<:BTC.BTC:bc1qaddress:50000000/21600/0 # Custom 21,600 block TTL (1.5 days)

Expiration Behavior:

- Expired limit swaps are automatically cleaned up

- Remaining funds are refunded to the original sender

- No manual intervention required

Processing Constraints

Block-level Constraints:

- Pool cycle blocks skip all swap processing

- Trading halts prevent swap execution

- Chain-specific ragnarok modes block swaps

Streaming Constraints:

- Minimum swap sizes apply (controlled by

StreamingSwapMinBPFee) - Maximum streaming length limits

- Interval-based execution timing

Rapid Swap Limits:

- Maximum iterations per block (default: 1)

- Configurable via

AdvSwapQueueRapidSwapMaxmimir - Prevents excessive processing overhead

Advanced Features

Swap Modification

Limit swaps can be modified or cancelled using the modify memo:

m=<:SOURCE:TARGET:NEWAMOUNT

Examples:

m=<:1234BTC.BTC:5678ETH.ETH:2500000000 # Modify target amount

m=<:1234BTC.BTC:5678ETH.ETH:0 # Cancel swap (set to 0)

Security:

- Only the original swap creator can modify

- Modification transaction funds are donated to pools

- Full validation of source and target assets

Telemetry and Monitoring

The advanced queue provides comprehensive metrics:

Core Metrics:

- Swap processing rates (market vs limit)

- Queue depths per trading pair

- Iteration counts and processing time

- Completion and expiration rates

Trading Pair Metrics:

- Per-pair limit swap counts

- Total value locked in limit swaps

- Average execution ratios

Performance Metrics:

- Rapid swap utilization

- Processing efficiency

- Queue congestion indicators

Migration from Legacy Queue

Compatibility

- Memo Compatibility: Legacy

SWAP:syntax still supported - Gradual Migration: Networks can enable advanced queue progressively

- Fallback Support: Automatic fallback to legacy queue when disabled

Benefits of Migration

- Better Performance: Rapid swap processing reduces queue congestion

- Enhanced UX: Limit swaps provide better price protection

- Improved Efficiency: Smarter indexing and processing algorithms

- Comprehensive Monitoring: Detailed telemetry for system health

Migration Considerations

- Node Operators: Monitor telemetry for performance insights

- Applications: Update to use new memo prefixes for optimal experience

- Users: Leverage limit swaps for better price execution

Best Practices

For Users

-

Use Appropriate Swap Types:

- Market swaps (

=) for "swap now at this price or better" - Limit swaps (

=<) for "swap when price reaches my target"

- Market swaps (

-

Set Realistic Limits:

- Consider current pool depths and volatility

- Account for fees in limit calculations

-

Monitor Expiration:

- Track limit swap TTL

- Consider custom TTL for longer-term swaps

For Developers

-

Leverage API Endpoints:

- Use

/thorchain/queue/limit_swapsfor monitoring (no filters required) - Query

/thorchain/queue/limit_swaps/summaryfor statistics - Filter by

source_asset,target_asset, orsenderas needed

- Use

-

Handle Expiration:

- Implement client-side TTL tracking

- Provide user notifications for approaching expiry

-

Optimize for Advanced Queue:

- Use new memo prefixes (

=,=<) - Implement retry logic for failed limit swaps

- Use new memo prefixes (

Example Use Cases

Immediate Execution with Price Protection

# Market swap: Convert 0.1 BTC to ETH immediately, refund if less than 2.5 ETH

=:ETH.ETH:0x742d35Cc891C0b8ee825C4645b3175d2346a3c85:250000000

Price-Protected Swap (Wait for Conditions)

# Limit swap: Wait until can get at least 2.5 ETH, then execute

=<:ETH.ETH:0x742d35Cc891C0b8ee825C4645b3175d2346a3c85:250000000

Rapid Streaming (Interval = 0)

# Rapid streaming: 5 sub-swaps as fast as possible (multiple per block)

=:ETH.ETH:0x742d35Cc891C0b8ee825C4645b3175d2346a3c85:250000000/0/5

Traditional Streaming (Interval ≥ 1)

# Traditional streaming: 5 sub-swaps every 10 blocks (one sub-swap per 10-block period)

=<:ETH.ETH:0x742d35Cc891C0b8ee825C4645b3175d2346a3c85:250000000/10/5

Custom TTL Limit Swap

# 1-day limit swap (14,400 blocks)

=<:ETH.ETH:0x742d35Cc891C0b8ee825C4645b3175d2346a3c85:250000000/14400/0

API Integration

Query all limit swaps:

curl "https://thornode.ninerealms.com/thorchain/queue/limit_swaps"

Query limit swaps by source asset:

curl "https://thornode.ninerealms.com/thorchain/queue/limit_swaps?source_asset=BTC.BTC&limit=50"

Query limit swaps by target asset:

curl "https://thornode.ninerealms.com/thorchain/queue/limit_swaps?target_asset=ETH.ETH"

Query limit swaps by sender:

curl "https://thornode.ninerealms.com/thorchain/queue/limit_swaps?sender=thor1abc123"

Get limit swap summary:

curl "https://thornode.ninerealms.com/thorchain/queue/limit_swaps/summary"

Check specific swap details:

curl "https://thornode.ninerealms.com/thorchain/queue/swap/details/{tx_id}"

For detailed API documentation, see the OpenAPI specification.

Fees and Wait Times

Fee Types

Users pay up to four kinds of fees when conducting a swap.

- Layer1 Network Fees (gas): paid by the user when sending the asset to THORChain to be swapped. This is controlled by the user's wallet.

- Slip Fee: protects the pool from being manipulated by large swaps. Calculated as a function of transaction size and current pool depth. The slip fee formula is explained here.

- Affiliate Fee - (optional) a percentage skimmed from the inbound amount that can be paid to exchanges or wallet providers. See the Affiliate Fee Guide and the Fees section for more details and setup information.

- Outbound Fee - the fee the Network pays on behalf of the user to send the outbound transaction. See Outbound Fee.

See the fees section for full details.

Refunds and Minimum Swap Amount

If a transaction fails, it is refunded, thus it will pay the outboundFee for the SourceChain not the DestinationChain. Thus devs should always swap an amount that is a maximum of the following, multiplied by at least a 4x buffer to allow for gas spikes:

- The Destination Chain outboundFee, or

- The Source Chain outboundFee, or

- $1.00 (the minimum outboundFee).

For convenience, a recommended_min_amount_in is included on the Swap Quote endpoint, which is the value described above. This value is priced in the inbound asset of the quote request (in 1e8). This should be the minimum-allowed swap amount for the requested quote. If a swap is attempted and fails due to insufficient funds to pay for fees, the endpoint will return an error message that includes the recommended minimum amount.

Wait Times

There are four phases of a transaction sent to THORChain each taking time to complete.

- Layer1 Inbound Confirmation - assuming the inboundTx will be confirmed in the next block, it is the source blockchain block time.

- Observation Counting - time for 67% THORChain Nodes to observe and agree on the inboundTx.

- Confirmation Counting - for non-instant finality blockchains, the amount of time THORChain will wait before processing to protect against double spends and re-org attacks.

- Outbound Delay - dependent on size and network traffic. Large outbounds will be delayed.

- Layer1 Outbound Confirmation - Outbound blockchain block time.

Wait times can be between a few seconds up to an hour. The assets being swapped, the size of the swap and the current network traffic within THORChain will determine the wait time.

See the delays.md section for full details.

THORName Guide

Summary

THORNames are THORChain's vanity address system that allows affiliates to collect fees and track their user's transactions. THORNames exist on the THORChain L1, so you will need a THORChain address and $RUNE to create and manage a THORName.

THORNames have the following properties:

- Name: The THORName's string. Between 1-30 hexadecimal characters and

-_+special characters. - Owner: This is the THORChain address that owns the THORName

- Aliases: THORNames can have an alias address for any external chain supported by THORChain, and can have an alias for the THORChain L1 that is different than the owner.

- Expiry: THORChain Block-height at which the THORName expires.

- Preferred Asset: The asset to pay out affiliate fees in. This can be any asset supported by THORChain.

Create a THORName

THORNames are created by posting a MsgDeposit to the THORChain network with the appropriate memo and enough $RUNE to cover the registration fee and to pay for the amount of blocks the THORName should be registered for.

- Registration fee:

tns_register_fee_runeon the Network endpoint. This value is in 1e8, so100000000 = 1 $RUNE - Per block fee:

tns_fee_per_block_runeon the same endpoint, also in 1e8.

For example, for a new THORName to be registered for 10 years the amount paid would be:

amt = tns_register_fee_rune + tns_fee_per_block_rune * 10 * 5256000

5256000 = avg # of blocks per year

The expiration of the THORName will automatically be set to the number of blocks in the future that was paid for minus the registration fee.

Memo Format:

Memo template is: ~:name:chain:address:?owner:?preferredAsset:?expiry

- name: Your THORName. Must be unique, between 1-30 characters, hexadecimal and

-_+special characters. - chain: The chain of the alias to set.

- address: The alias address. Must be an address of chain.

- owner: THORChain address of owner (optional).

- preferredAsset: Asset to receive fees in. Must be supported be an active pool on THORChain. Value should be

assetproperty from the Pools endpoint.

This will register a new THORName called ODIN with a Bitcoin alias of bc1Address owner of thorAddress and preferred asset of BTC.BTC.

You can use Asgardex to post a MsgDeposit with a custom memo. Load your wallet, then open your THORChain wallet page > Deposit > Custom.

View your THORName's configuration at the THORName endpoint:

e.g. https://thornode.ninerealms.com/thorchain/thorname/{name}

Renewing your THORName

All THORName's have a expiration represented by a THORChain block-height. Once the expiration block-height has passed, another THORChain address can claim the THORName and any associated balance in the Affiliate Fee Collector Module (Read #preferred-asset-for-affiliate-fees), so it's important to monitor this and renew your THORName as needed.

To keep your THORName registered you can extend the registration period (move back the expiration block height), by posting a MsgDeposit with the correct THORName memo and $RUNE amount.

Memo:

~:ODIN:THOR:<thor-alias-address>

(Chain and alias address are required, so just use current values to keep alias unchanged).

$RUNE Amount:

rune_amt = num_blocks_to_extend * tns_fee_per_block

(Remember this value will be in 1e8, so adjust accordingly for your transaction).

Preferred Asset for Affiliate Fees

Affiliates can collect their fees in the asset of their choice (choosing from the assets that have a pool on THORChain). In order to collect fees in a preferred asset, affiliates must use a THORName in their swap memos.

Configuring a Preferred Asset for a THORName

- Register a THORName if not done already. This is done with a

MsgDepositposted to the THORChain network. - Set your preferred asset's chain alias (the address you'll be paid out to), and your preferred asset. Note: your preferred asset must be currently supported by THORChain.

For example, if you wanted to be paid out in USDC you would:

-

Grab the full USDC name from the Pools endpoint:

ETH.USDC-0XA0B86991C6218B36C1D19D4A2E9EB0CE3606EB48 -

Post a

MsgDepositto the THORChain network with the appropriate memo to register your THORName, set your preferred asset as USDC, and set your Ethereum network address alias. Assuming the following info:- THORChain address:

thor1dl7un46w7l7f3ewrnrm6nq58nerjtp0dradjtd - THORName:

ac-test - ETH payout address:

0x6621d872f17109d6601c49edba526ebcfd332d5d

The full memo would look like:

~:ac-test:ETH:0x6621d872f17109d6601c49edba526ebcfd332d5d:thor1dl7un46w7l7f3ewrnrm6nq58nerjtp0dradjtd:ETH.USDC-0XA0B86991C6218B36C1D19D4A2E9EB0CE3606EB48 - THORChain address:

You can use Asgardex to post a MsgDeposit with a custom memo. Load your wallet, then open your THORChain wallet page > Deposit > Custom.

You will also need a THOR alias set to collect affiliate fees. Use another MsgDeposit with memo: ~:<thorname>:THOR:<thorchain-address> to set your THOR alias. Your THOR alias address can be the same as your owner address, but won't be used for anything if a preferred asset is set.

Once you successfully post your MsgDeposit you can verify that your THORName is configured properly. View your THORName info from THORNode at the following endpoint:

https://thornode.ninerealms.com/thorchain/thorname/ac-test

The response should look like:

{

"name": "ac-test",

"expire_block_height": 28061405,

"owner": "thor19phfqh3ce3nnjhh0cssn433nydq9shx7wfmk7k",

"preferred_asset": "BNB.BUSD-BD1",

"affiliate_collector_rune": "0",

"aliases": [

{

"chain": "ETH",

"address": "0x3021c479f7f8c9f1d5c7d8523ba5e22c0bcb5430"

},

{

"chain": "THOR",

"address": "thor19phfqh3ce3nnjhh0cssn433nydq9shx7wfmk7k"

},

{

"chain": "BNB",

"address": "bnb1laxspje9u0faauqh7j07p9x6ds8lg4ychhg5qh"

}

],

"preferred_asset_swap_threshold_rune": "0"

}

Your THORName is now properly configured and any affiliate fees will begin accruing in the AffiliateCollector module. You can verify that fees are being collected by checking the affiliate_collector_rune value of the above endpoint.

Affiliate Fee Guide

Affiliate fees provide a way for interfaces to generate revenue through THORChain. These fees are collected from select transactions, sent to an affiliate collector module, and periodically distributed in a gas-efficient manner using the interface's preferred asset. These fees range from 0 to 10,000 basis points (bps), where 100 bps equals 1%, and are deducted from either the inbound or outbound transaction amount.

Overview

- Fee Structure: Affiliate fees are calculated in basis points and deducted from the transaction amount.

- THORName Requirement: A valid THORName is required to collect affiliate fees. Learn how to create a THORName here.

- Preferred Asset: By default, affiliates are paid in $RUNE, but a preferred asset can be specified using a THORName.

- Multiple Affiliates for Swaps: Swaps can support multiple affiliate fees, while single affiliate fees apply to savings deposits and RUNE pool withdrawals.

- Automatic Distribution: Affiliate fees are automatically distributed to the affiliate address within your THORName based on accumulated thresholds. No manual processing is required.

Getting Started

- Create a THORName: See the THORName Guide for instructions.

- Set Up Your Preferred Asset: Configure your preferred asset, such as USDC or BTC. By default, the affiliate asset is $RUNE.

- Enable Multiple Affiliates: Set up multiple affiliate addresses for swap transactions.

- Set the Affiliate Fee Amount: Specify the affiliate fee in basis points (0–10,000) in your transactions. See Transaction Memos for details.

- Start Using THORChain: Let the affiliate collector module handle the periodic distribution of fees.

Where the Affiliate Fee is Taken

- If the inbound swap asset is a native THORChain asset ($RUNE, synth, or trade asset), the affiliate fee amount will be deducted directly from the transaction amount.

- If the inbound swap asset is on any other chain, the network will submit a swap to $RUNE.

- If the affiliate is added to an

ADDLPtransaction, then the affiliate is included in the network as an LP. - If the affiliate is added to a RUNEPool withdrawal, it is deducted from the profit amount (positive PnL), not the principal.

How it Works

The affiliate fee system operates automatically, following these steps:

- Transaction Execution: When a transaction includes an affiliate fee, the specified amount (in basis points) is deducted from the inbound or outbound transaction amount as described above.

- Fee Collection: The deducted fee is collected in the AffiliateCollector module, where it is held in $RUNE by default.

- Threshold Check: The network continuously monitors the accumulated $RUNE for each affiliate. Once the balance exceeds

PreferredAssetOutboundFeeMultipliermultiplied by the chain's outbound fee, the system initiates a swap to the preferred asset.- Example: If the outbound fee for BTC is 0.00005 BTC and the multiplier is 200, the swap will occur when the collected $RUNE is worth 0.01 BTC.

- Preferred Asset Swap: If the affiliate's THORName specifies a preferred asset (e.g., BTC, USDC), the network swaps $RUNE to that asset before distribution. If no preferred asset is set, $RUNE is distributed directly.

- Automatic Distribution: The converted (or original) amount is sent to the affiliate's address without requiring any manual intervention.

Benefits of Automatic Distribution

- Gas Efficiency: By waiting until the threshold is met, the network minimizes gas costs associated with frequent small transactions.

- Asset Flexibility: Affiliates can specify any supported asset as their preferred payout, ensuring they receive fees in the most convenient form.

Multiple Affiliates

Interfaces can define up to a limit set by MultipleAffiliatesMaxCount for valid affiliate and affiliate basis points pairs in a swap memo. This is used if more than one affiliate needs to be paid, e.g. an interface and implementation partner. The network deducts a fee for each valid affiliate defined in the memo. Alternatively, up to 5 valid affiliates and exactly one valid basis point value can be defined, and the network will attempt to skim the same basis point fee for each affiliate.

Valid Memo Examples

-

=:ETH.ETH:0x3021c479f7f8c9f1d5c7d8523ba5e22c0bcb5430::t1/t2/t3/t4/t5:10

(Will skim 10 basis points for each of the affiliates) -

=:ETH.ETH:0x3021c479f7f8c9f1d5c7d8523ba5e22c0bcb5430::t1/thor1t2hav42urasnsvwa6x6fyezaex9f953plh72pq/t3:10/20/30

(Will skim 10 basis points fort1, 20 basis points forthor1t2hav42urasnsvwa6x6fyezaex9f953plh72pq, and 30 basis points fort3)

Invalid Memo Examples

-

=:ETH.ETH:0x3021c479f7f8c9f1d5c7d8523ba5e22c0bcb5430::t1/t2/t3/t4/t5:10/20

(5 affiliates defined, but only 2 affiliate basis point values) -

=:ETH.ETH:0x3021c479f7f8c9f1d5c7d8523ba5e22c0bcb5430::t1/t2/t3/t4/t5/t6:10

(Too many affiliates defined)

Connecting to THORChain

This guide helps developers connect to THORChain’s network for querying data, building wallets, dashboards, or debugging network issues. THORChain provides four primary data sources:

- Midgard: Consumer data for swaps, pools, and volume, ideal for dashboards.

- THORNode: Raw blockchain data for THORChain-specific queries, used by wallets and explorers.

- Cosmos RPC: Generic Cosmos SDK data, such as balances and transactions.

- Tendermint RPC: Consensus and node status data for monitoring.

The below endpoints are run by specific organisations for public use. There is a cost to running these services. If you want to run your own full node, please see https://docs.thorchain.org/thornodes/overview. A list of endpoints operated by Nine Realms is located at NineRealms THORChain Ops Dashboard

Quick Reference

| Source | Purpose | Mainnet URLs | Stagenet URLs |

|---|---|---|---|

| Midgard | Swap, pool, volume, and user data | - midgard.thorswap.net - midgard.ninerealms.com - midgard.thorchain.liquify.com | - stagenet-midgard.ninerealms.com |

| THORNode | THORChain-specific blockchain data | - thornode.thorswap.net - thornode.ninerealms.com - thornode.thorchain.liquify.com - Pre-hard-fork (blocks ≤4786559): thornode-v0.ninerealms.com | - stagenet-thornode.ninerealms.com |

| Cosmos RPC | Cosmos SDK data (e.g., balances) | - Example: thornode.ninerealms.com | - Not publicly available; run a node |

| Tendermint RPC | Consensus and node status data | - rpc.ninerealms.com - rpc.thorchain.liquify.com - rpc.thorswap.net - Pre-hard-fork (blocks ≤4786559): rpc-v0.ninerealms.com | - stagenet-rpc.ninerealms.com |

Usage Guidelines

- Rate Limits: Public endpoints may enforce limits (e.g., 100 requests/minute for Midgard). Check provider docs or contact operators (e.g., THORSwap, Nine Realms).

- Run Your Own Node: For production apps, run a THORNode to avoid rate limits and ensure uptime. See THORNode Setup Guide.

- Hard-Fork Note: Mainnet hard-fork at block 4786560 requires post-hard-fork endpoints for newer data; use pre-hard-fork endpoints for historical queries (blocks ≤4786559).

- Error Handling: Handle HTTP 429 (rate limit) or 503 (node overload) with exponential backoff for retries.

Midgard

Midgard provides time-series data for swaps, pools, volume, and liquidity providers, ideal for dashboards and analytics. It proxies THORNode queries to reduce network load and runs on every node.

- Mainnet:

- Stagenet:

THORNode

THORNode provides raw blockchain data (e.g., balances, transactions) specific to THORChain’s state machine, critical for wallets and block explorers. Avoid excessive queries to public nodes to prevent overloading.

- Mainnet (for post-hard-fork blocks 4786560 and later):

- Stagenet:

Cosmos RPC

Cosmos RPC provides generic Cosmos SDK data (e.g., account balances, transactions). Common endpoints include /cosmos/bank/v1beta1/balances and /cosmos/base/tendermint/v1beta1/blocks. Not all endpoints are enabled.

Archive node RPC links can be found at: https://ops.ninerealms.com/links.

Cosmos Documentation

- Cosmos SDK v0.50 RPC - Cosmos gRPC Guide

Cosmos Endpoints

Use THORNode URLs with /cosmos/... paths.

- Example

Tendermint RPC

Tendermint (CometBFT) RPC provides consensus and node status data (e.g., block height, validator status), useful for monitoring and debugging.

Tendermint Documentation

- CometBFT v0.38 RPC - CometBFT RPC Guide

Ports

- MAINNET Port:

27147 - STAGENET Port:

26657

Tendermint RPC Endpoints

- Mainnet: (for post-hard-fork blocks 4786560 and later)

- Mainnet:Pre-hard-fork blocks 4786559 and earlier.

- Stagenet:

P2P

P2P is the peer-to-peer network layer for node communication, useful for debugging connectivity issues between THORChain nodes.

- MAINNET Port:

27146 - STAGENET Port:

26656

P2P Guide

Example: Check Peer Connections

curl -X GET "https://rpc.ninerealms.com/net_info" -H "accept: application/json"

Querying THORChain

Supported Address Formats

Below are the list of supported Address Formats. Not using this risks loss of funds.

| Chain | Supported Address Format | Notes |

|---|---|---|

| BTC | P2WSH /w Bech32 (preferred), P2WPKH /w Bech32, P2PKH, P2SH, P2TR | Do not send below the dust threshold. Do not use exotic spend scripts, locks or address formats |

| ETH | EIP-55 (inbounds support EIP-7702) | Do not swap to smart contract addresses (including EIP-7702). |

| BSC | EIP-55 (inbounds support EIP-7702) | Do not swap to smart contract addresses (including EIP-7702). |

| AVAX | EIP-55 (inbounds support EIP-7702) | Do not swap to smart contract addresses (including EIP-7702). |

| BASE | EIP-55 (inbounds support EIP-7702) | Do not swap to smart contract addresses (including EIP-7702). |

| TRON | Base58 | Do not swap to smart contract addresses (including EIP-7702). |

| DOGE | Bech32, P2PKH | Do not send below the dust threshold. Do not use exotic spend scripts, locks or address formats |

| LTC | Bech32, P2PKH | Do not send below the dust threshold. Do not use exotic spend scripts, locks or address formats |

| BCH | Bech32, P2PKH | Do not send below the dust threshold. Do not use exotic spend scripts, locks or address formats |

| GAIA (cosmoshub) | Bech32 (supports both Secp256k1 and Ed25519) | THORChain now supports EDDSA (Ed25519) addresses in addition to the traditional Secp256k1. |

| XRP | Classic Base58 | Avoid destination tags unless required by receiving wallet. Leave 1 XRP minimum for migration |

All inbound_address support this format.

Getting the Asgard Vault

Vaults are fetched from the /inbound_addresses endpoint:

https://thornode.ninerealms.com/thorchain/inbound_addresses

You need to select the address of the Chain the inbound transaction. See supported address formats.

The address will be the current active Asgard Address that accepts inbounds. Do not cache these address as they change regularly. Do not delay inbound transactions (e.g. do not use future timeLocks).

Example Output, each connected chain will be displayed.

{

"chain": "BTC",

"pub_key": "thorpub1addwnpepqf33c0dn8wqey2xcj0fe34kn3hhpz3z3vsjvke3f5mhdq5xumajmc7k89fv",

"address": "bc1qjrj4cw7x46m2rxa78y32kv6nhzzssmvmpyfpcz",

"halted": false,

"global_trading_paused": false,

"chain_trading_paused": false,

"chain_lp_actions_paused": false,

"observed_fee_rate": "2",

"gas_rate": "3",

"gas_rate_units": "satsperbyte",

"outbound_tx_size": "1000",

"outbound_fee": "903",

"dust_threshold": "10000"

}

Never cache vault addresses, they churn regularly!

Inbound transactions should not be delayed for any reason else there is risk funds will be sent to an unreachable address. Use standard transactions, check the inbound address before sending and use the recommended gas rate to ensure transactions are confirmed in the next block to the latest Inbound_Address.

If a chain has a router on the inbound address endpoint, then everything must be deposited via the router. The router is a contract that the user first approves, and the deposit call transfers the asset into the network and emits an event to THORChain.

This is done because "tokens" on protocols don't support memos on-chain, thus need to be wrapped by a router which can force a memo.

Note: you can transfer the base asset, eg ETH, directly to the address and skip the router, but it is recommended to deposit everything via the router.

{

"address": "0x500b62a37c1afe79d59b373639512d03e3c4f5e8",

"chain": "ETH",

"gas_rate": "70",

"halted": false,

"pub_key": "thorpub1addwnpepq05w4xwaswph29ksls25ymjkypav30t8ktyu2dqzkxqk3pkf2l5zklvfzef",

"router": "0xD37BbE5744D730a1d98d8DC97c42F0Ca46aD7146"

}

If you connect to a public Midgard, you must be conscious of the fact that you can be phished and could send money to the WRONG vault. You should do safety checks, i.e. comparing with other nodes, or even inspecting the vault itself for the presence of funds. You should also consider running your own 'fullnode' instance to query for trusted data.

Chain: Chain NameAddress: Asgard Vault inbound address for that chain.,Halted: Boolean, if the chain is halted. This should be monitored.gas_rate: rate to be used, e.g. in Stats or GWei. This represents the current gas price for transactions on that chain. For EVM chains, this is in Gwei. For UTXO chains, this is in sats/byte. Use this value when constructing transactions to ensure proper fee estimation. See Fees and Wait Times for more details.

Displaying available pairs

Use the /pools endpoint of Midgard to retrieve all swappable assets on THORChain. The response will be an array of objects like this:

{

"annualPercentageRate": "0.013025968330830473",

"asset": "AVAX.USDC-0XB97EF9EF8734C71904D8002F8B6BC66DD9C48A6E",

"assetDepth": "44984823069671",

"assetPrice": "0.7628247087053169",

"assetPriceUSD": "1",

"earnings": "17038463728",

"earningsAnnualAsPercentOfDepth": "0.012945072714771326",

"liquidityUnits": "92700911990602",

"lpLuvi": "-0.9995183044925366",

"nativeDecimal": "6",

"poolAPY": "0.013025968330830473",

"runeDepth": "34315534554282",

"saversAPR": "0",

"saversDepth": "64514721140337",

"saversUnits": "57164578167010",

"saversYieldShare": "NaN",

"status": "available",

"synthSupply": "65229115178334",

"synthUnits": "244408597168005",

"totalCollateral": "0",

"totalDebtTor": "0",

"units": "337109509158607",

"volume24h": "5772328862793"

}

`"assetPrice" tells you the asset's price in RUNE (RUNE Depth/AssetDepth ). In the above example;

1 ETH.USDC = 0.76282 RUNE

Decimals and Base Units

All values on THORChain (thornode and Midgard) are given in 1e8 eg, 100000000 base units (like Bitcoin), and unless postpended by "USD", they are in units of RUNE. Even 1e18 assets, such as ETH.ETH, are shortened to 1e8. 1e6 Assets like ETH.USDC, are padded to 1e8. THORNode will tell you the decimals for each asset, giving you the opportunity to convert back to native units in your interface.

See code examples using the THORChain xchain package here https://github.com/xchainjs/xchainjs-lib/tree/master/packages/xchain-thorchain

Finding Chain Status

There are two ways to see if a Chain is halted.

- Looking at the

/inbound_addressesendpoint and inspecting the halted flag. - Looking at Mimir and inspecting the HALT[Chain]TRADING setting. See network-halts.md for more details.

Sending Transactions

Confirm you have:

- Connected to Midgard or THORNode

- Located the latest vault (and router) for the chain

- Prepared the transaction details (and memo)

- Checked the network is not halted for your transaction

You are ready to make the transaction and swap via THORChain.

UTXO Chains

Memo less or equal 80 characters

For UTXO-based chains (e.g., BTC, BCH, LTC, DOGE), transactions must follow a specific structure to be processed by THORChain. Ensure the following steps are completed to avoid transaction failures or loss of funds.

Checklist for UTXO Transactions

- Verify supported address type: Ensure the address type (e.g., P2PKH, P2SH) is supported by THORChain. Check supported formats in Querying THORChain.

- Set Asgard vault as VOUT0: Send the transaction amount to the current Asgard vault address as the first output (VOUT0), obtainable from the Inbound Addresses endpoint.

- Return change to VIN0: Direct all change back to the input address (VIN0) in a subsequent output, e.g., VOUT1, as THORChain identifies the user by VIN0 for refunds.

- Include memo in OP_RETURN: Add the transaction memo as an OP_RETURN output, typically in VOUT2, to specify the user’s intent (e.g., swap, add liquidity). Refer to Memos for format details.

-

Use sufficient gas rate: Set a

gas_ratehigh enough to ensure inclusion in the next block, as specified in the Inbound Addresses endpoint. - Exceed dust threshold: Ensure the transaction amount exceeds the chain’s dust threshold. Verify the latest values in the Inbound Addresses endpoint or Dust Thresholds and Transaction Validation.

- Limit to 10 outputs: Ensure the transaction has no more than 10 outputs to comply with THORChain’s processing limits.

- Do not send funds that are part of a transaction with more than 10 outputs

Memo greater than 80 characters

- Ensure the address type is supported

- Send the transaction with Asgard vault as VOUT0

- Pass all change back to the VIN0 address in a subsequent VOUT e.g. VOUT1

- Take the first 79 characters of the memo and append '^' and use that as an OP_RETURN in a subsequent VOUT e.g. VOUT2

-

Add remaining characters encoded as p2wpkh address as subsequent VOUT

- encode remaining characters to hex representation

- split the resulting string into chunks of 40 characters each, append "00" to the last chunk until its length also matches 40 characters

-

for each hex encoded chunk, create a VOUT sending the minimum allowed amount of sats for the specific chain to the script pub key: '0014' +

<chunk>

-

Use a high enough

gas_rateto be included - Do not send below the dust threshold (10k Sats BTC, BCH, LTC, 1m DOGE), exhaustive values can be found on the Inbound Addresses endpoint

Examples using dummy txs

P2WPKH (BTC, LTC)

Memo:

SWAP:GAIA.ATOM:cosmos1fegapd4jc3ejqeg0eu3jk4hvr74hg66076gyyd/bc1qnfw0gkk05qxl38mslc69hc6vc64mksyw6zzxhg

- Put first 79 characters +

^intoOP_RETURN:SWAP:GAIA.ATOM:cosmos1fegapd4jc3ejqeg0eu3jk4hvr74hg66076gyyd/bc1qnfw0gkk05qxl38^ - Hex encode remaining string

mslc69hc6vc64mksyw6zzxhgand split it into chunks of 40 characters (fill the last chunk with zeros):6d736c633639686336766336346d6b737977367a,7a78686700000000000000000000000000000000 - Create two subsequent VOUTs (prepend

0014):- send 294sats (2940sats on LTC) to:

00146d736c633639686336766336346d6b737977367a- BTC: bc1qd4ekccek895xxdnkvvmrgmttwduhwdn622k6gj

- LTC: ltc1qd4ekccek895xxdnkvvmrgmttwduhwdn6wkv7sz

- send 294sats (2940sats on LTC) to:

00147a78686700000000000000000000000000000000- BTC: bc1q0fuxsecqqqqqqqqqqqqqqqqqqqqqqqqq2alhdv

- LTC: ltc1q0fuxsecqqqqqqqqqqqqqqqqqqqqqqqqqwp9n4u

- send 294sats (2940sats on LTC) to:

P2PKH (BCH, DOGE)

Memo:

SWAP:GAIA.ATOM:cosmos1fegapd4jc3ejqeg0eu3jk4hvr74hg66076gyyd/bc1qnfw0gkk05qxl38mslc69hc6vc64mksyw6zzxhg

- Put first 79 characters +

^intoOP_RETURN:SWAP:GAIA.ATOM:cosmos1fegapd4jc3ejqeg0eu3jk4hvr74hg66076gyyd/bc1qnfw0gkk05qxl38^ - Hex encode remaining string

mslc69hc6vc64mksyw6zzxhgand split it into chunks of 40 characters (fill the last chunk with zeros):6d736c633639686336766336346d6b737977367a,7a78686700000000000000000000000000000000 - Create two subsequent VOUTs (prepend

76a914& append88ac):- send 546sats to:

76a9146d736c633639686336766336346d6b737977367a88ac- BCH: qpkhxmrrxcukscekwe3nvdrdddehjaek0gldczy2mv

- DOGE: DF7pTvdzyY2zoVJ3AFQr8oSYDiqw3m6hCy

- send 546sats to:

76a9147a7868670000000000000000000000000000000088ac- BCH: qpa8s6r8qqqqqqqqqqqqqqqqqqqqqqqqqq99h3g9e2

- DOGE: DGJfDk6cwyNpzebP7MyzueRtXEWGEaaHz9

- send 546sats to:

Inbound transactions must not be delayed to avoid sending funds to an outdated Asgard vault address, which may be unreachable. Use standard transactions, verify the latest Asgard vault address via the Inbound Addresses endpoint, and use the recommended gas_rate to ensure confirmation in the next block.

Memo limited to 80 bytes in OP_RETURN on BTC, BCH, LTC and DOGE. Use abbreviated options where possible.